163 J State Conformity Chart

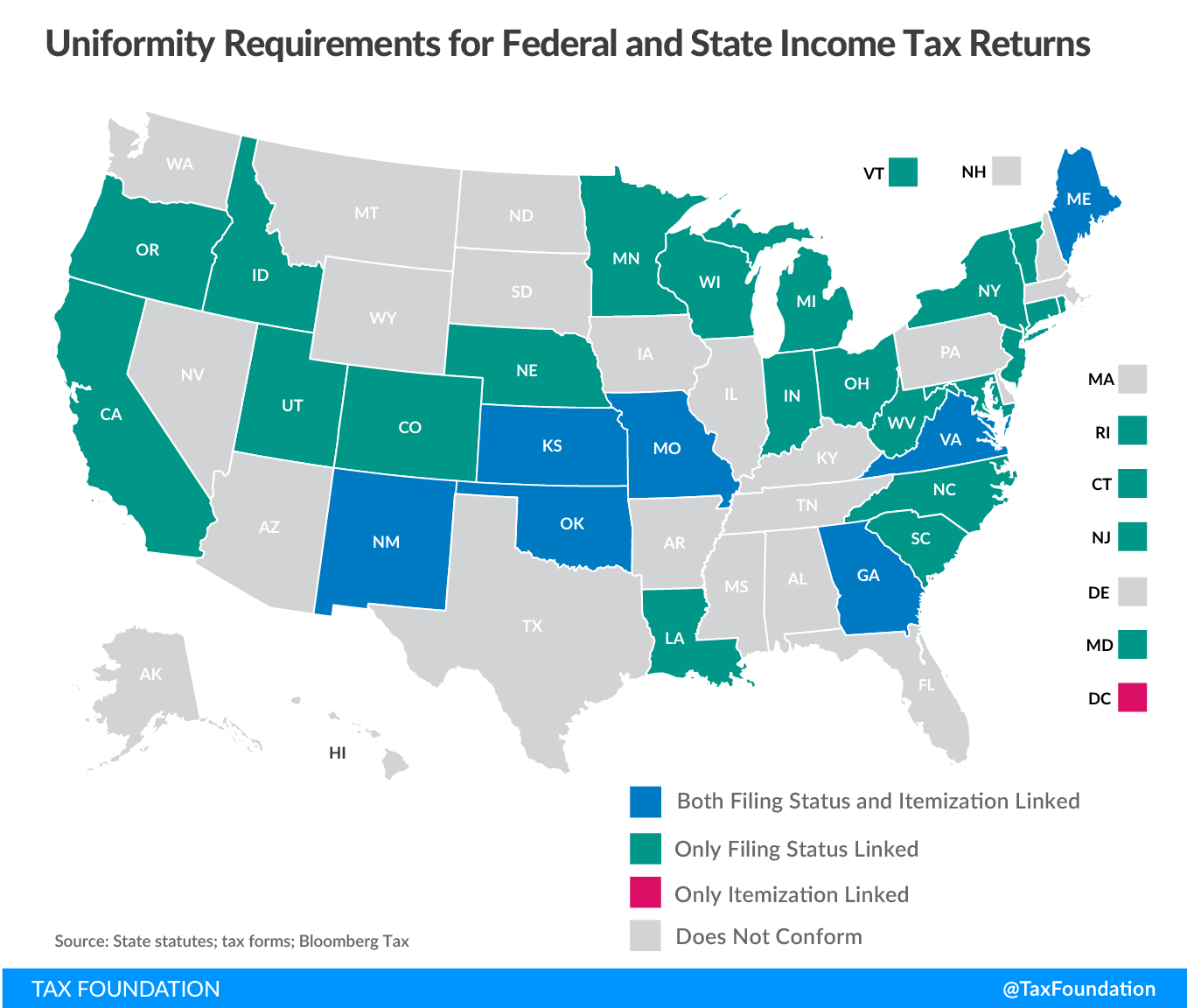

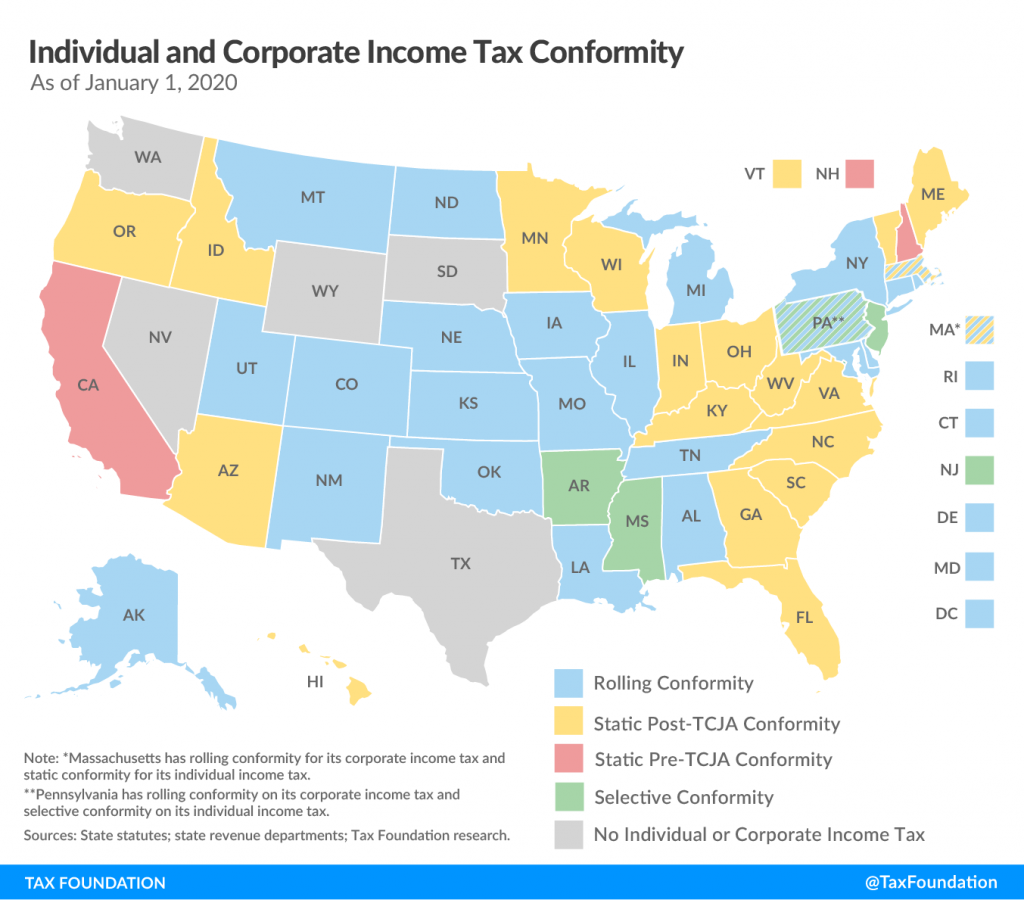

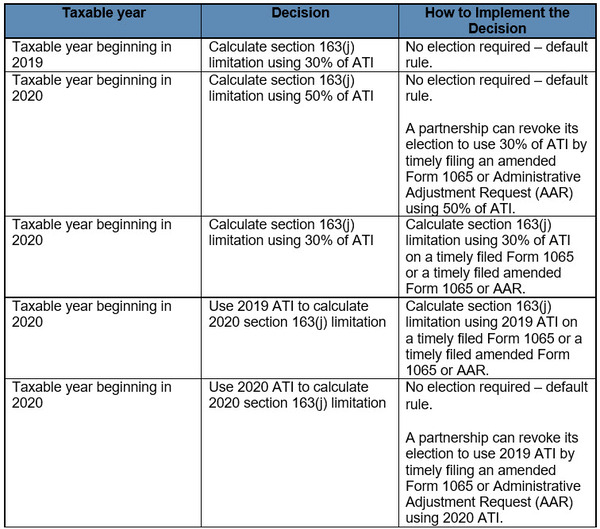

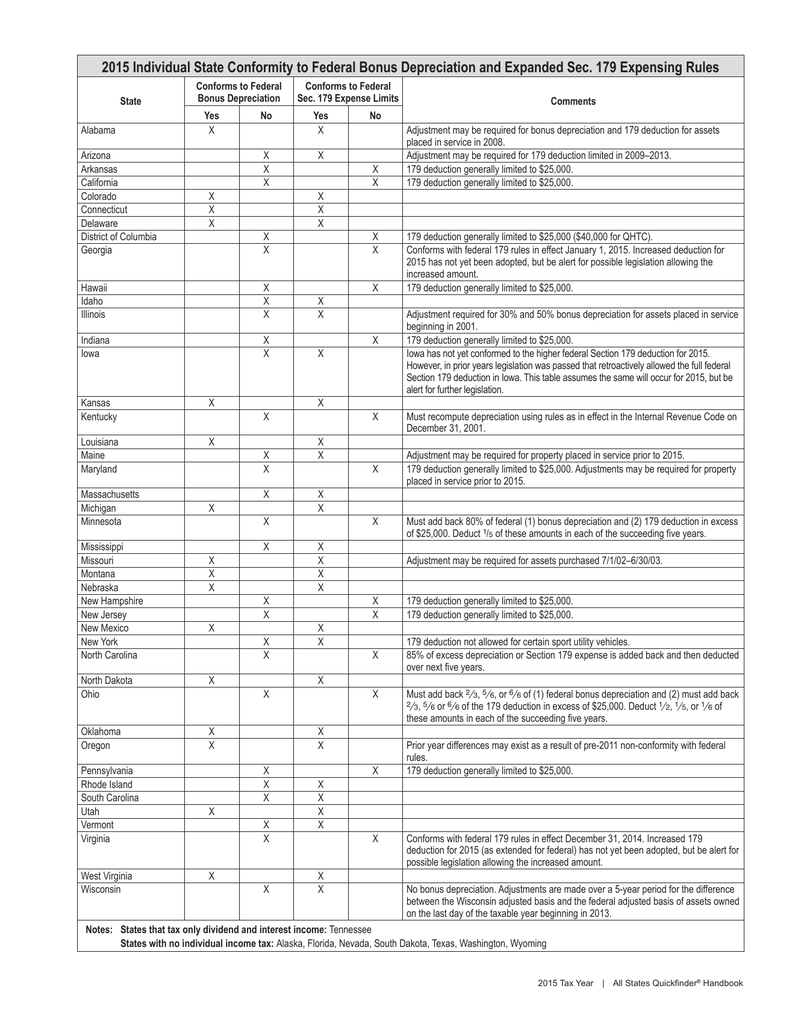

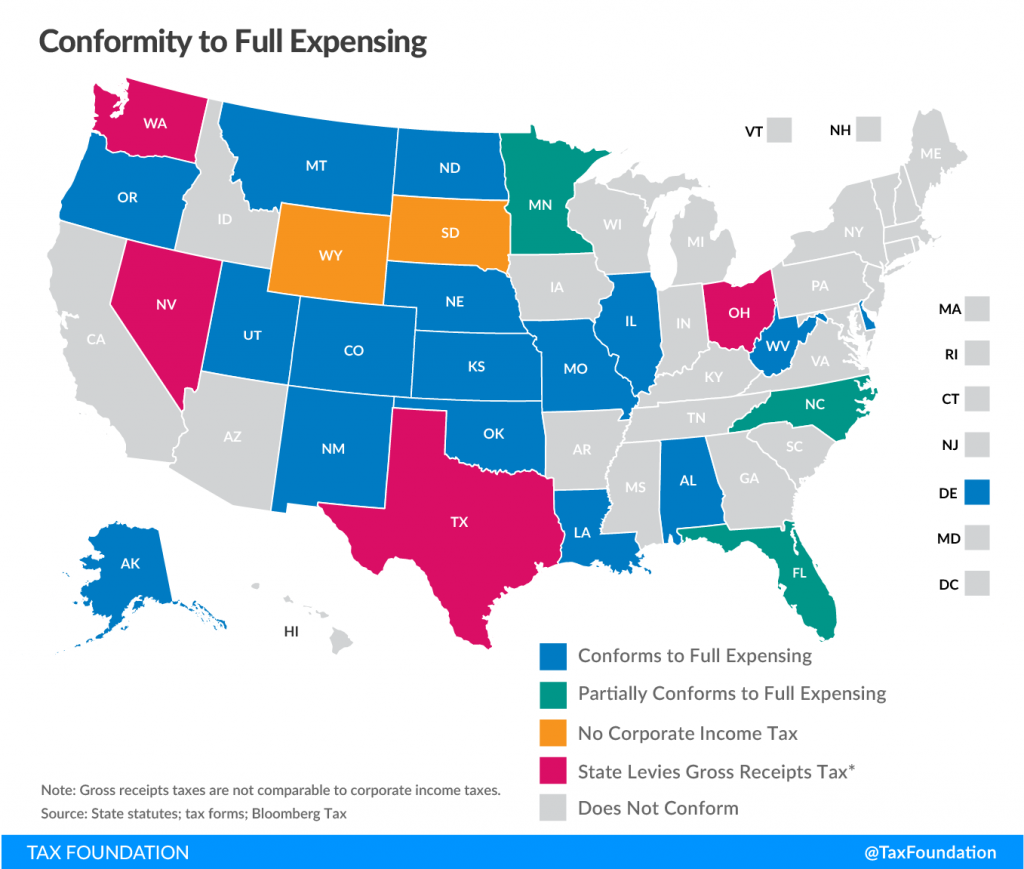

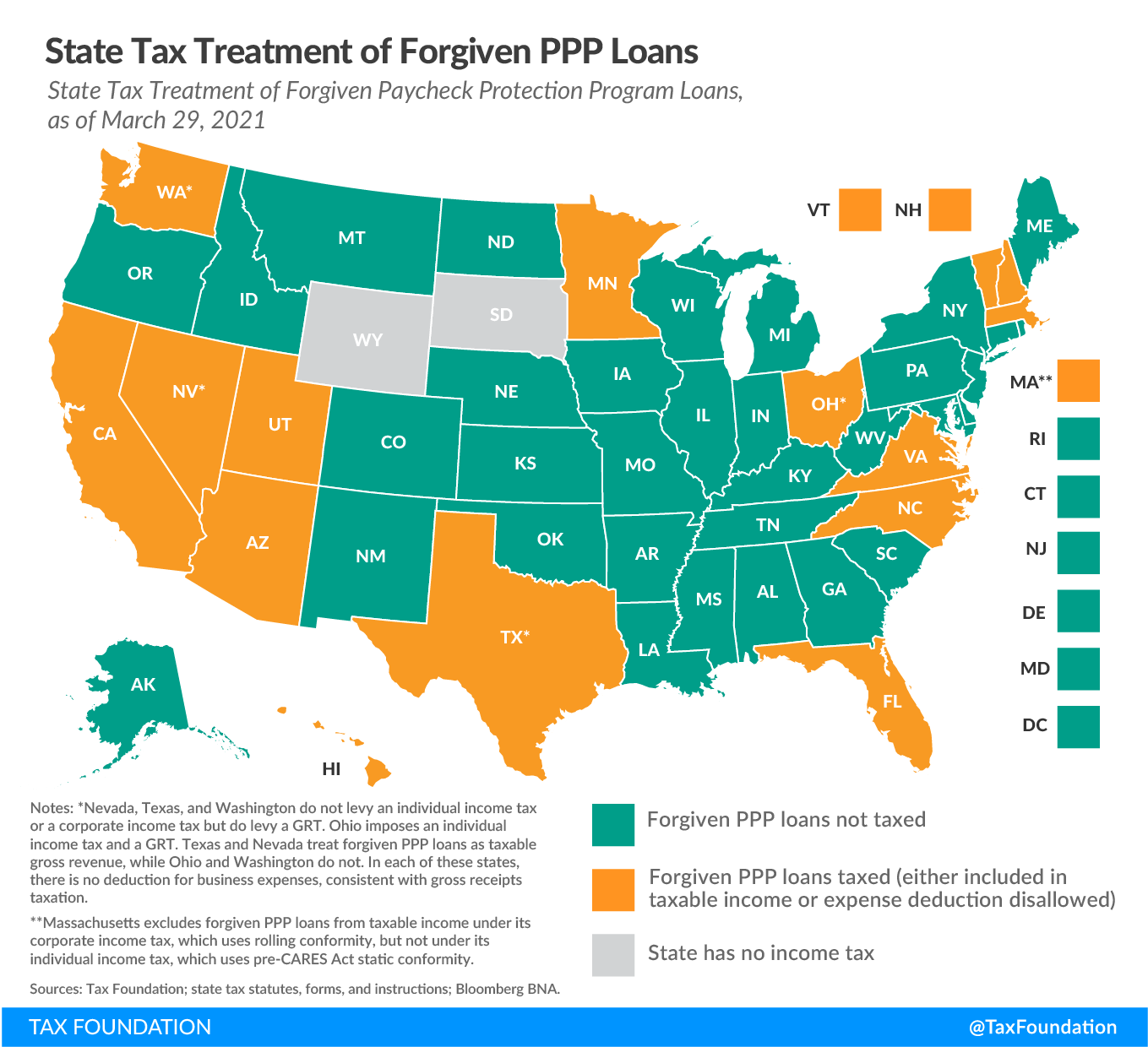

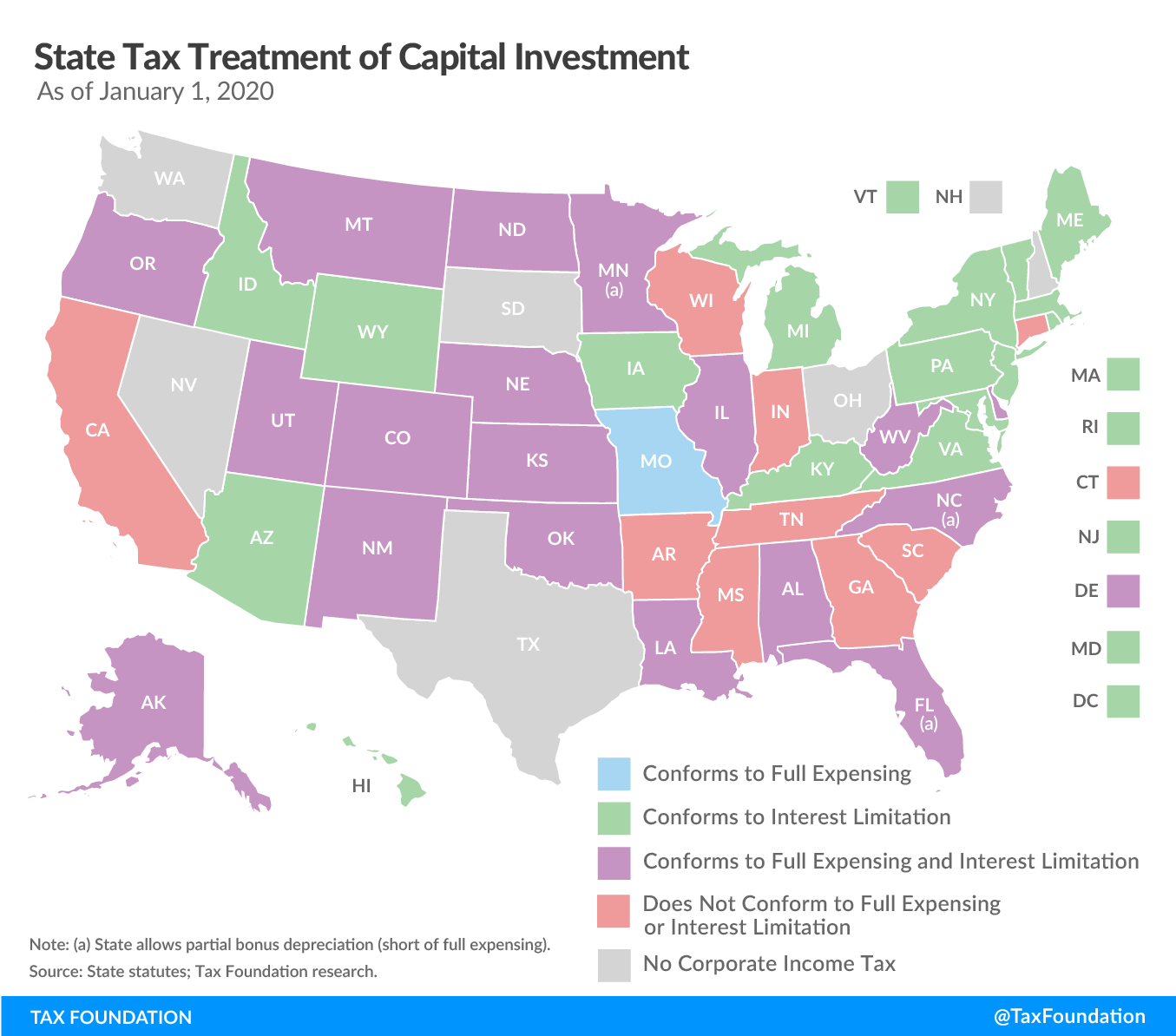

163 J State Conformity Chart - In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that generally. Following the enactment of the tcja, many states. Many states do not conform to the interest expense limitation under 163(j). Those differences generally fall into three categories: In addition, a taxpayer may elect for any tax year beginning in 2020 to use its. Do state adjustments from sec. These maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163 (j) interest expense limitation, 80% cap rules, and qualified improvement. Section 163 (j) imposed a limit on the deductibility of business interest expense equal to the sum of business interest income, 30% of “adjusted taxable income,” and “floor. 163(j) chart identifies which states conform to cares act increase in ati to 50% as of march 27, 2020. Decouples from the limitation under irc sec. Recent federal tax law changes can affect each u.s. In addition, a taxpayer may elect for any tax year beginning in 2020 to use its. In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that generally. Section 163 (j) imposed a limit on the deductibility of business interest expense equal to the sum of business interest income, 30% of “adjusted taxable income,” and “floor. Do state adjustments from sec. 163 (j) provisions under the cares act? Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. A taxpayer may elect not to use the 50 percent ati limit in 2019 or 2020, but continue to use the 30 percent limit. Following the enactment of the tcja, many states. 163 (j) under the tcja automatically apply to sec. 163 (j) under the tcja automatically apply to sec. Recent federal tax law changes can affect each u.s. 163 (j) provisions under the cares act? Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Section 163 (j) imposed a limit on the deductibility of business interest expense equal to the. These maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163 (j) interest expense limitation, 80% cap rules, and qualified improvement. 163(j) chart identifies which states conform to cares act increase in ati to 50% as of march 27, 2020. 163 (j) provisions under the cares act? Those differences generally fall into. Do state adjustments from sec. Those differences generally fall into three categories: A taxpayer may elect not to use the 50 percent ati limit in 2019 or 2020, but continue to use the 30 percent limit. Many states do not conform to the interest expense limitation under 163(j). 163 (j) under the tcja automatically apply to sec. Those differences generally fall into three categories: State’s taxpayers differently, depending partly on the state’s method of conformity to the internal revenue code. In addition, a taxpayer may elect for any tax year beginning in 2020 to use its. 163 (j) under the tcja automatically apply to sec. 163(j) chart identifies which states conform to cares act increase in ati. State’s taxpayers differently, depending partly on the state’s method of conformity to the internal revenue code. Decouples from the limitation under irc sec. A taxpayer may elect not to use the 50 percent ati limit in 2019 or 2020, but continue to use the 30 percent limit. 163 (j) under the tcja automatically apply to sec. Recent federal tax law. In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that generally. Those differences generally fall into three categories: Decouples from the limitation under irc sec. In addition, a taxpayer may elect for any tax year beginning in 2020 to use its. State’s taxpayers. Do state adjustments from sec. Following the enactment of the tcja, many states. Decouples from the limitation under irc sec. 163 (j) provisions under the cares act? Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Those differences generally fall into three categories: A taxpayer may elect not to use the 50 percent ati limit in 2019 or 2020, but continue to use the 30 percent limit. Section 163 (j) imposed a limit on the deductibility of business interest expense equal to the sum of business interest income, 30% of “adjusted taxable income,” and “floor. Recent. Do state adjustments from sec. In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that generally. Those differences generally fall into three categories: State’s taxpayers differently, depending partly on the state’s method of conformity to the internal revenue code. These maps track specific. 163(j) chart identifies which states conform to cares act increase in ati to 50% as of march 27, 2020. Those differences generally fall into three categories: 163 (j) provisions under the cares act? In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that. 163 (j) provisions under the cares act? In addition to showing state carryback and carryforward allowances, the table shows the status of states’ conformity to the cares act’s suspension of the tcja limit that generally. A taxpayer may elect not to use the 50 percent ati limit in 2019 or 2020, but continue to use the 30 percent limit. Those differences generally fall into three categories: These maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163 (j) interest expense limitation, 80% cap rules, and qualified improvement. In addition, a taxpayer may elect for any tax year beginning in 2020 to use its. 163(j) chart identifies which states conform to cares act increase in ati to 50% as of march 27, 2020. 163 (j) under the tcja automatically apply to sec. Decouples from the limitation under irc sec. Following the enactment of the tcja, many states. Differences in federal and state law add complexity in determining how section 163 (j) applies at the state level. Recent federal tax law changes can affect each u.s.State Conformity to CARES Act, American Rescue Plan Tax Foundation

State Tax Conformity a Year After Federal Tax Reform

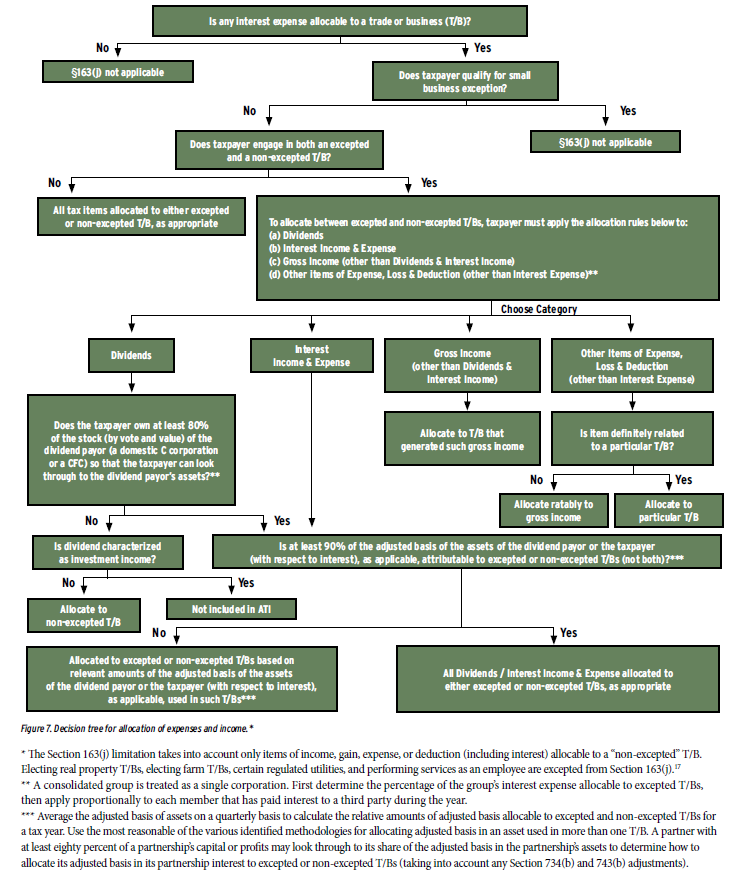

Part I The Graphic Guide to Section 163(j) Tax Executive

GILTI and Other Conformity Issues Still Loom for States in 2020

Federal Tax Reform Amended Sec. 163(j) Interest Expense Limitation and State Tax Conformity

A Matter of Interest To Elect or Not to Elect the CARES Act Modifications to Section 163(j

163 J State Conformity Chart Portal.posgradount.edu.pe

State Tax Conformity a Year After Federal Tax Reform

State Conformity to CARES Act, American Rescue Plan Tax Foundation

Will Arizona Lead the Way on Full Expensing This Year? Upstate Tax Professionals

Section 163 (J) Imposed A Limit On The Deductibility Of Business Interest Expense Equal To The Sum Of Business Interest Income, 30% Of “Adjusted Taxable Income,” And “Floor.

Many States Do Not Conform To The Interest Expense Limitation Under 163(J).

State’s Taxpayers Differently, Depending Partly On The State’s Method Of Conformity To The Internal Revenue Code.

Do State Adjustments From Sec.

Related Post: