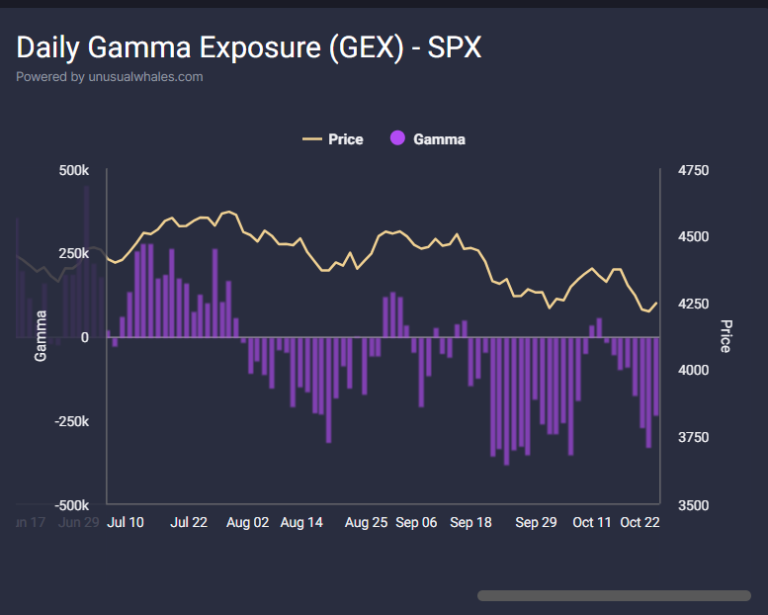

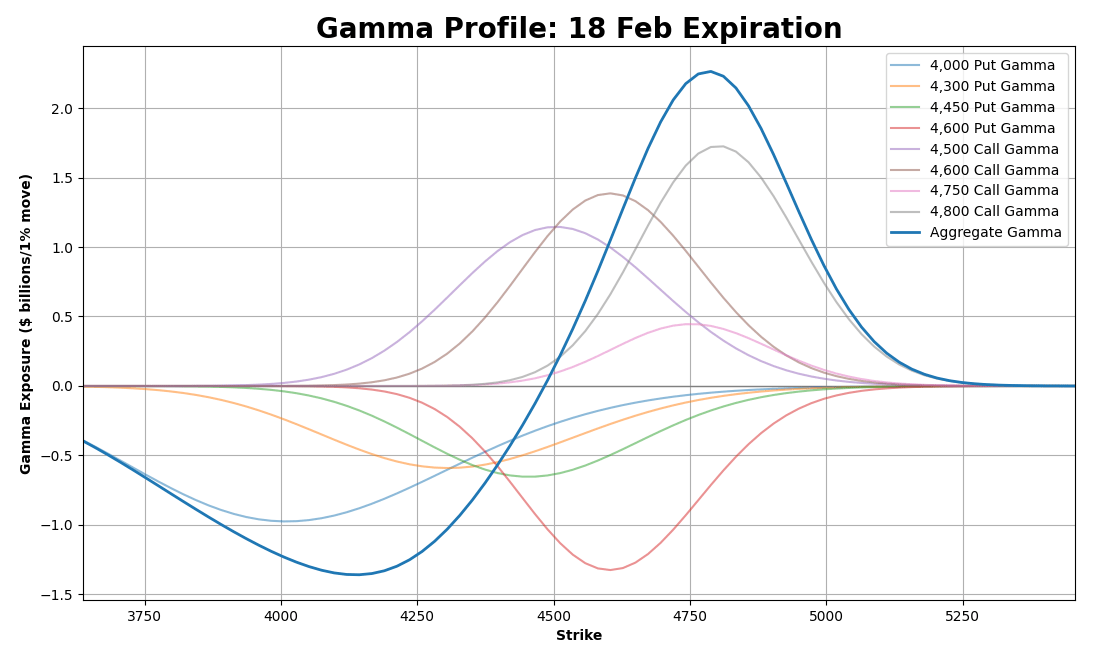

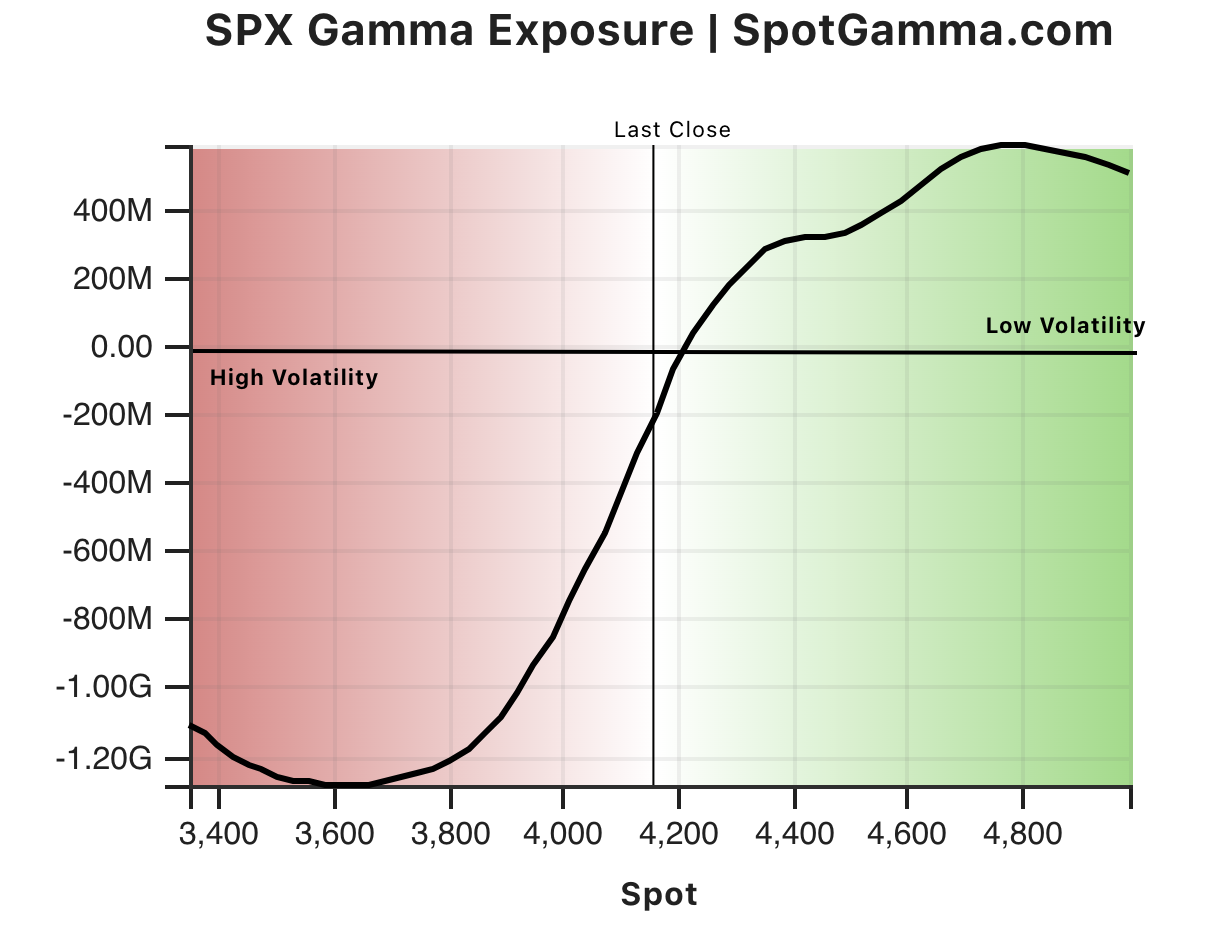

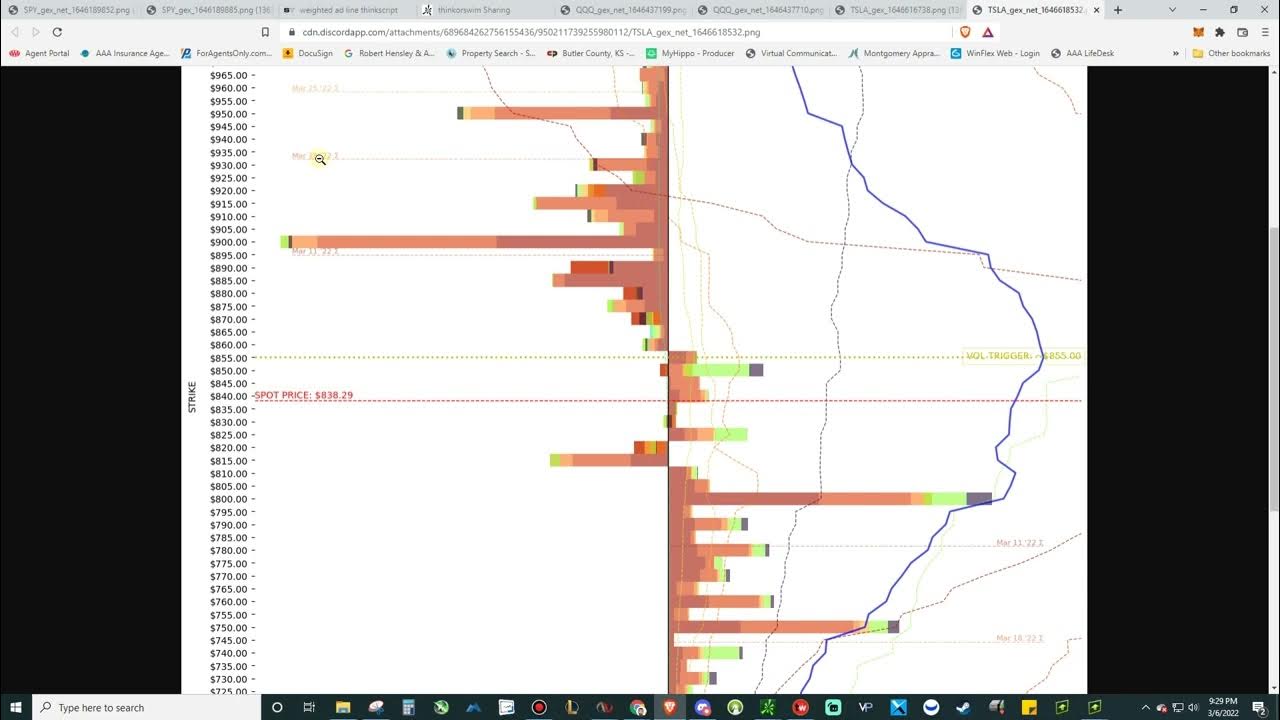

Gamma Exposure Gex Chart

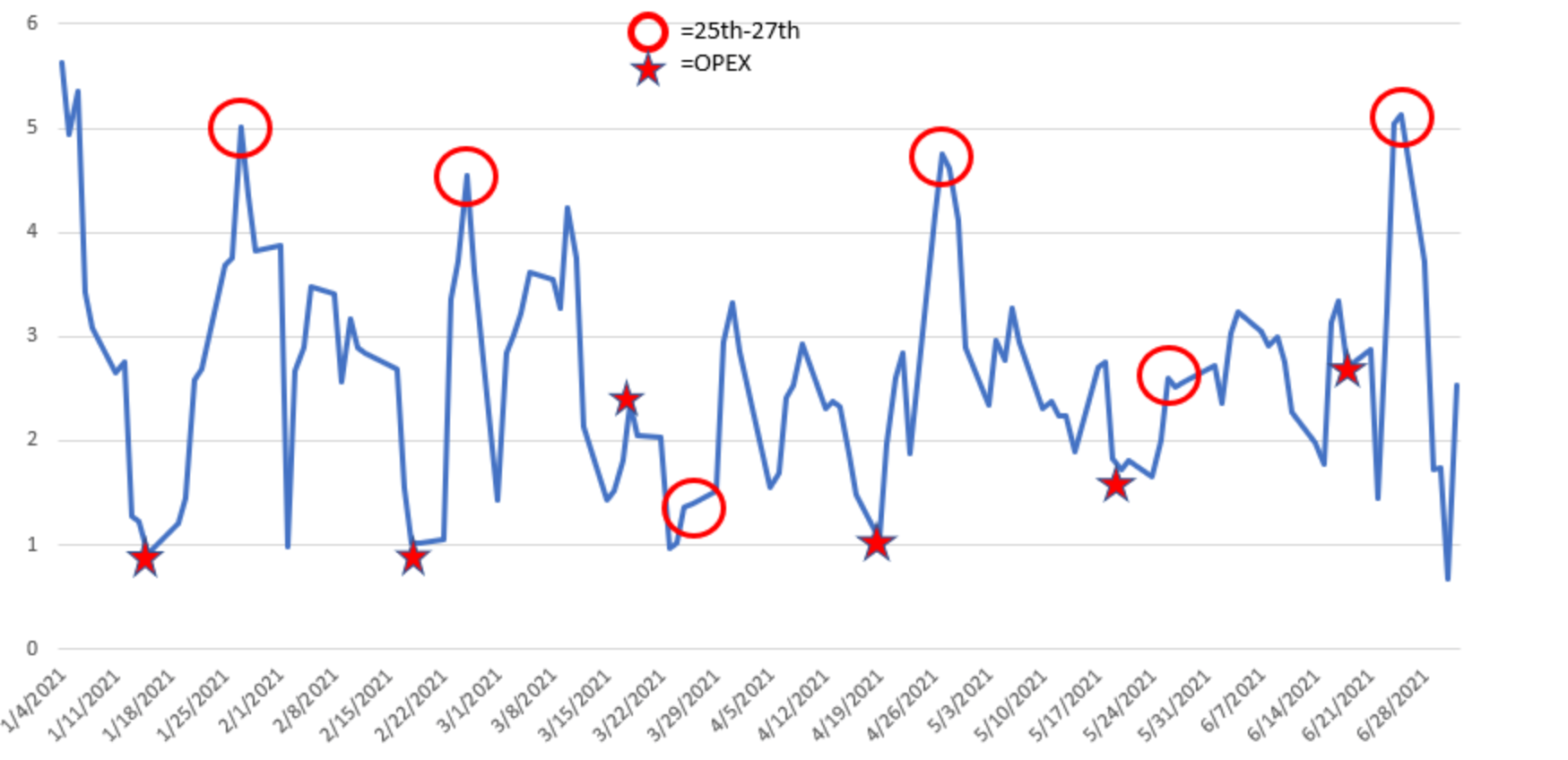

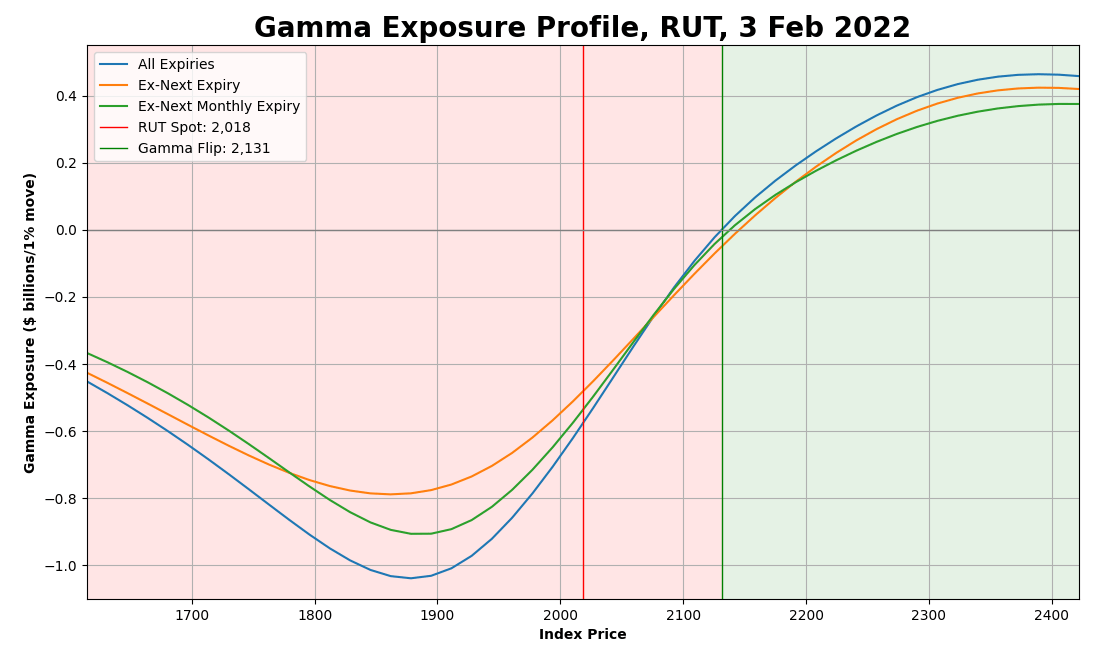

Gamma Exposure Gex Chart - Track essential gex levels across expirations with our unique cumulative (⅀) and selected alone (⊙) calculation models. Track live gamma exposure levels and uncover dealer positions to navigate market dynamics. Gamma exposure (gex) also known as gamma levels, measures the change in delta exposure for options based on changes in the underlying price. They allow traders to quickly identify areas where gamma is increasing or decreasing. The gamma exposure (gex) for $spx options. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Gexduck.com is a comprehensive platform designed to provide investors and traders with valuable insights into market dynamics through gamma exposure (gex) data. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. Gamma exposure is the estimated dollar value that option sellers must hedge for every 1% change in the underlying asset's price to remain. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. They allow traders to quickly identify areas where gamma is increasing or decreasing. Track live gamma exposure levels and uncover dealer positions to navigate market dynamics. Track essential gex levels across expirations with our unique cumulative (⅀) and selected alone (⊙) calculation models. Gamma exposure is the estimated dollar value that option sellers must hedge for every 1% change in the underlying asset's price to remain. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Gexduck.com is a comprehensive platform designed to provide investors and traders with valuable insights into market dynamics through gamma exposure (gex) data. The gamma exposure (gex) for $spx options. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. Gamma exposure (gex) also known as gamma levels, measures the change in delta exposure for options based on changes in the underlying price. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Track live gamma exposure levels and uncover dealer positions to navigate market dynamics. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. They allow traders to quickly identify areas where gamma is increasing or decreasing. Gamma exposure (gex) also. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. They allow traders to quickly identify areas where gamma is increasing or decreasing. Gamma charts visualize the. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. They allow traders to quickly identify areas where gamma is increasing or decreasing. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. Gamma exposure is the estimated dollar. Gamma exposure (gex) also known as gamma levels, measures the change in delta exposure for options based on changes in the underlying price. The gamma exposure (gex) for $spx options. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must. The gamma exposure (gex) for $spx options. They allow traders to quickly identify areas where gamma is increasing or decreasing. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price. Gamma exposure is the estimated dollar value that option sellers must hedge for every 1% change in the underlying asset's price to remain. They allow traders to quickly identify areas where gamma is increasing or decreasing. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Track essential gex levels across expirations with our. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Gexduck.com is a comprehensive platform designed to provide investors and traders with valuable insights into market dynamics through gamma exposure (gex) data. The gamma exposure (gex) for $spx options. Track live gamma exposure levels and uncover dealer positions to navigate market dynamics. Gamma exposure. Gexduck.com is a comprehensive platform designed to provide investors and traders with valuable insights into market dynamics through gamma exposure (gex) data. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. Gamma exposure (gex) also known as gamma levels, measures the change in delta exposure for options based on changes in the underlying price. Track. The gamma exposure (gex) for $spx options. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. Gamma exposure (gex) also known as gamma levels, measures the change in delta exposure for options based on changes in the underlying price. They allow traders. Track essential gex levels across expirations with our unique cumulative (⅀) and selected alone (⊙) calculation models. Visualize live options flow showing calls and puts that are bought and sold across strike prices,. Gamma exposure is the estimated dollar value that option sellers must hedge for every 1% change in the underlying asset's price to remain. They allow traders to. Gamma exposure is the estimated dollar value that option sellers must hedge for every 1% change in the underlying asset's price to remain. Track essential gex levels across expirations with our unique cumulative (⅀) and selected alone (⊙) calculation models. Spot gamma exposure (gex) is the estimated dollar value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement. Gamma charts visualize the aggregate gamma exposure for an index or stock over time. They allow traders to quickly identify areas where gamma is increasing or decreasing. Gexduck.com is a comprehensive platform designed to provide investors and traders with valuable insights into market dynamics through gamma exposure (gex) data. The gamma exposure (gex) for $spx options. Track live gamma exposure levels and uncover dealer positions to navigate market dynamics.What is GEX? The Ultimate Guide to Gamma Exposure

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev Financial Training

Free Gamma Exposure Chart SpotGamma™

Intro to Gamma Exposure Charts and how to create your own gamma levels YouTube

HedgePulse RealTime GEX, Delta Charts & Market Breadth

Gamma & Gamma Exposure What Traders Need to Know — Opinicus 🦅

The Wheel Screener So You’ve Heard About Gamma Exposure (GEX). But What About Vanna and Charm

Gamma Exposure (GEX), Gamma Levels, and SPX 0DTE What You Need To Know — Opinicus 🦅

How to Use Gamma Exposure to Trade SPY GEX Analysis YouTube

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level

Gamma Exposure (Gex) Also Known As Gamma Levels, Measures The Change In Delta Exposure For Options Based On Changes In The Underlying Price.

Visualize Live Options Flow Showing Calls And Puts That Are Bought And Sold Across Strike Prices,.

Related Post: