Hst Chart

Hst Chart - Gst/hst for businesses you may be looking for: On december 12, 2024, the legislation to enact the goods and services tax/harmonized sales tax (gst/hst) break was passed into law by the government of canada. Compare the gst/hst filing methods and choose one best suited for your return: During the tax break, no gst. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Cra account, netfile form, financial institution, accounting software, phone, or mail. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Gst/hst credit payments for individuals how to charge, remit, and report the goods and services tax (gst) and the. Gst/hst calculator (and rates) fuse this calculator to find out the amount of tax that applies to sales in canada, and access the gst/hst provincial rates table. Gst/hst calculator (and rates) fuse this calculator to find out the amount of tax that applies to sales in canada, and access the gst/hst provincial rates table. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Gst/hst for businesses you may be looking for: Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. During the tax break, no gst. Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed to enable gst/hst registrants to validate the gst/hst account number of a supplier, thereby. Gst/hst credit payments for individuals how to charge, remit, and report the goods and services tax (gst) and the. Cra account, netfile form, financial institution, accounting software, phone, or mail. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. Cra account, netfile form, financial institution, accounting software, phone, or mail. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Gst/hst credit payments for individuals how to charge, remit, and report the. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. Gst/hst calculator (and rates) fuse this calculator to find out the amount of tax that applies to sales in canada, and access the gst/hst provincial rates table. During the tax break, no gst. Gst/hst credit payments for individuals how to charge, remit,. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Gst/hst for businesses you may be looking for: Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. During the tax break, no gst. Gst/hst calculator (and rates) fuse this calculator. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. On december 12, 2024, the legislation to enact the goods and services tax/harmonized sales tax (gst/hst) break was passed into law by the government of canada. Gst/hst for businesses you may be looking for: Compare the gst/hst filing methods and. Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed to enable gst/hst registrants to validate the gst/hst account number of a supplier, thereby. Compare the gst/hst filing methods and choose one best suited for your return: Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. Gst/hst. Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed to enable gst/hst registrants to validate the gst/hst account number of a supplier, thereby. During the tax break, no gst. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Learn how to file your gst/hst. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Gst/hst for businesses you may be looking for: Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed to enable gst/hst registrants to validate the gst/hst account number of a supplier,. Gst/hst calculator (and rates) fuse this calculator to find out the amount of tax that applies to sales in canada, and access the gst/hst provincial rates table. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. On december 12, 2024, the legislation to enact the goods and services tax/harmonized sales tax (gst/hst) break was passed into law by the. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Cra account, netfile form, financial institution, accounting software, phone, or mail. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Gst/hst for businesses you. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Gst/hst for businesses you may be looking for: Gst/hst credit payments for individuals how to charge, remit, and report the goods and services tax (gst) and the. During the tax break, no gst. General information for individuals on goods and services tax/harmonized sales tax (gst/hst) credit such as application, eligibility, calculation and payments. Compare the gst/hst filing methods and choose one best suited for your return: On december 12, 2024, the legislation to enact the goods and services tax/harmonized sales tax (gst/hst) break was passed into law by the government of canada. Closed there was a temporary gst/hst break on certain items from december 14, 2024, to february 15, 2025. Welcome page to the canada revenue agency (cra) gst/hst registry that has been designed to enable gst/hst registrants to validate the gst/hst account number of a supplier, thereby.how to make magic 8 half square triangle units All about patchwork and quilting

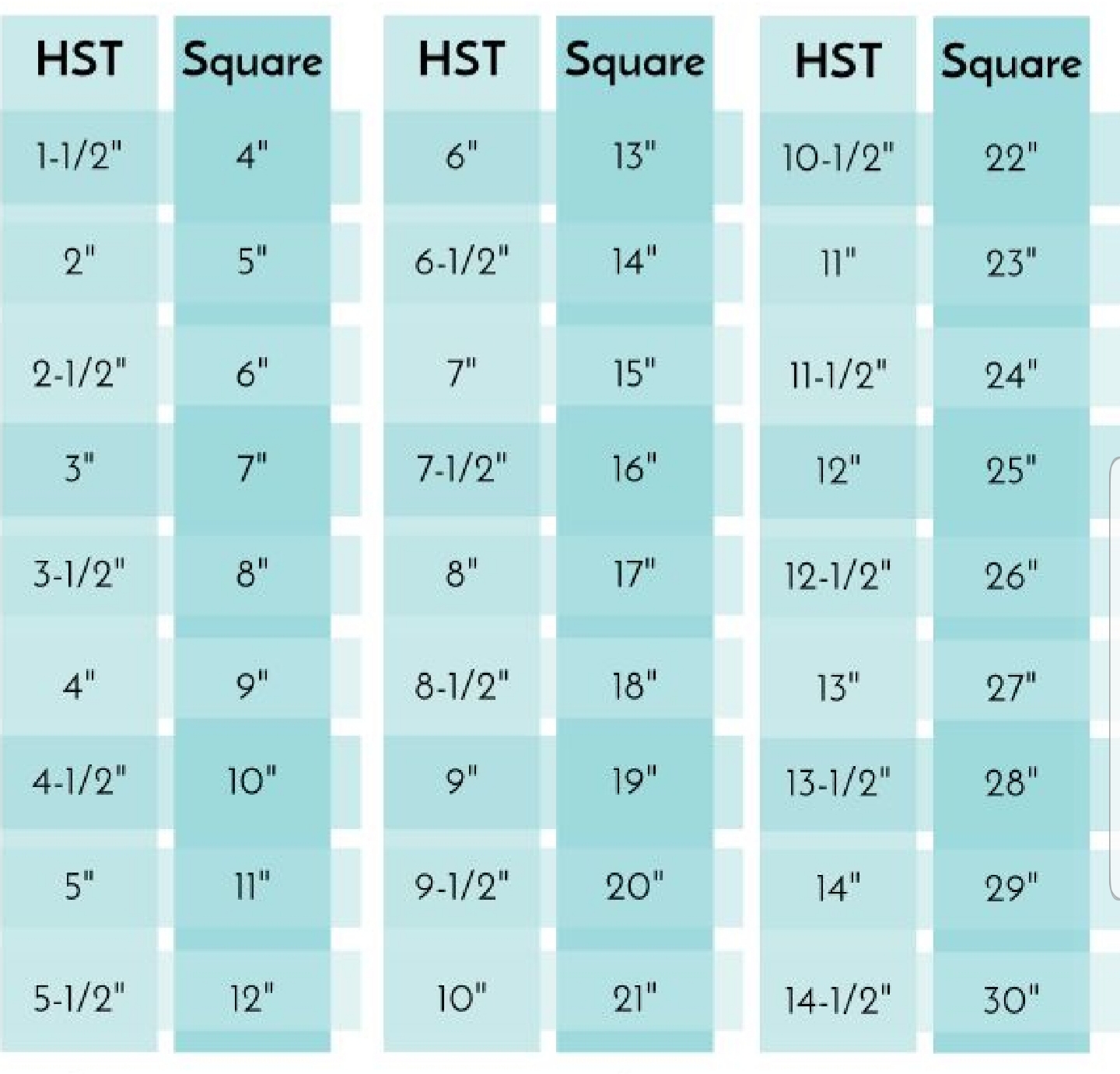

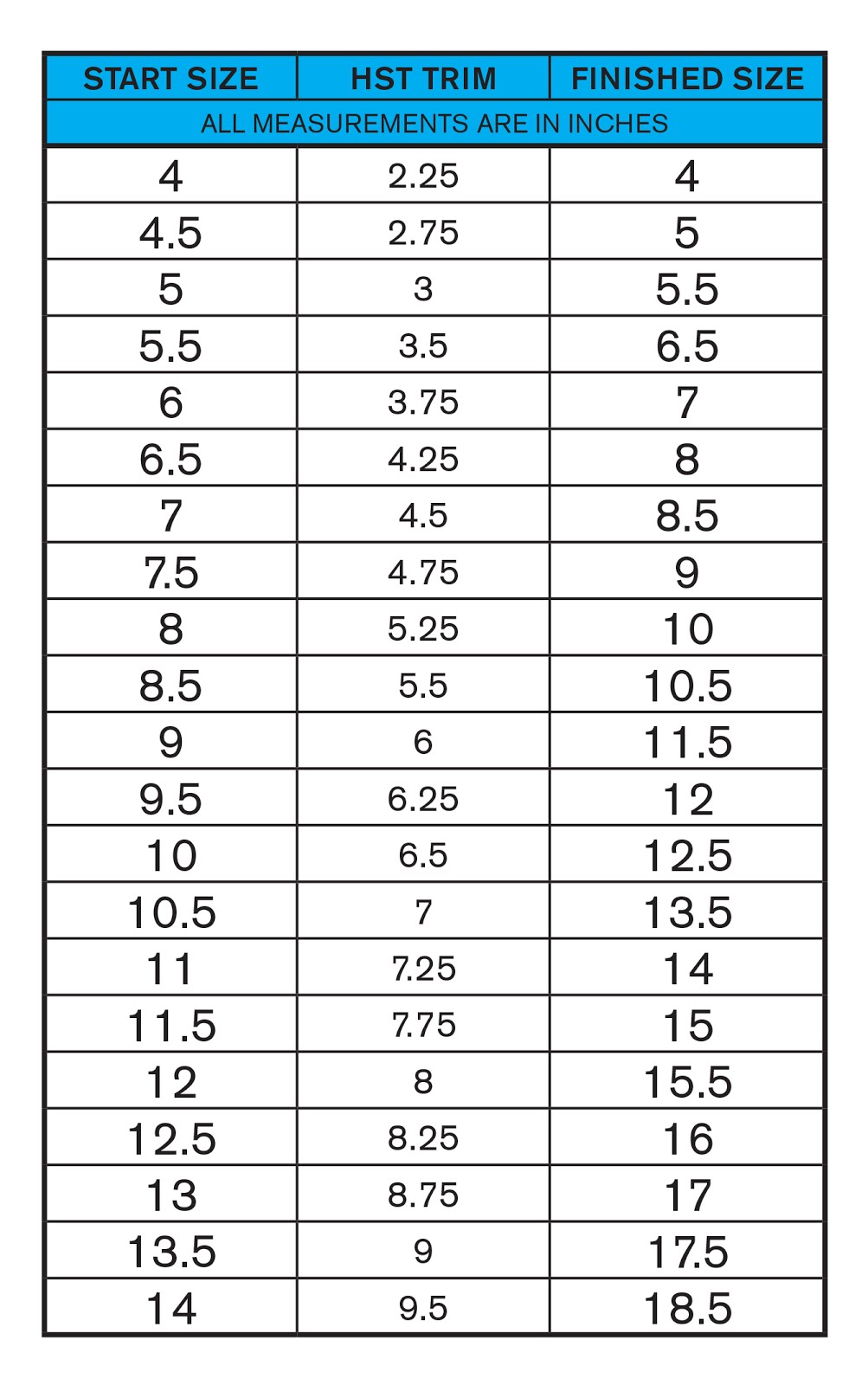

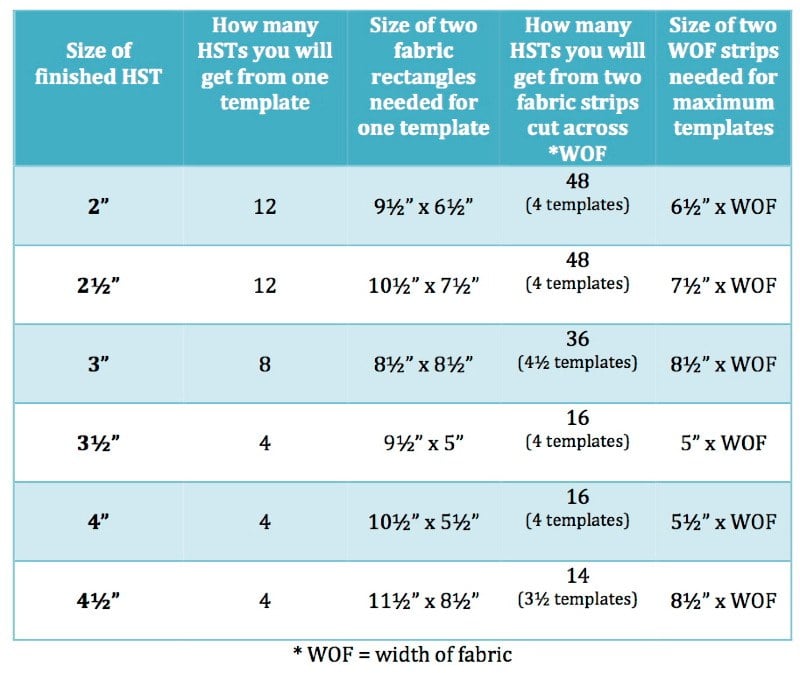

HST 8 at a Time Instructions and Chart Triangle ruler, Easy quilt patterns, Half square triangles

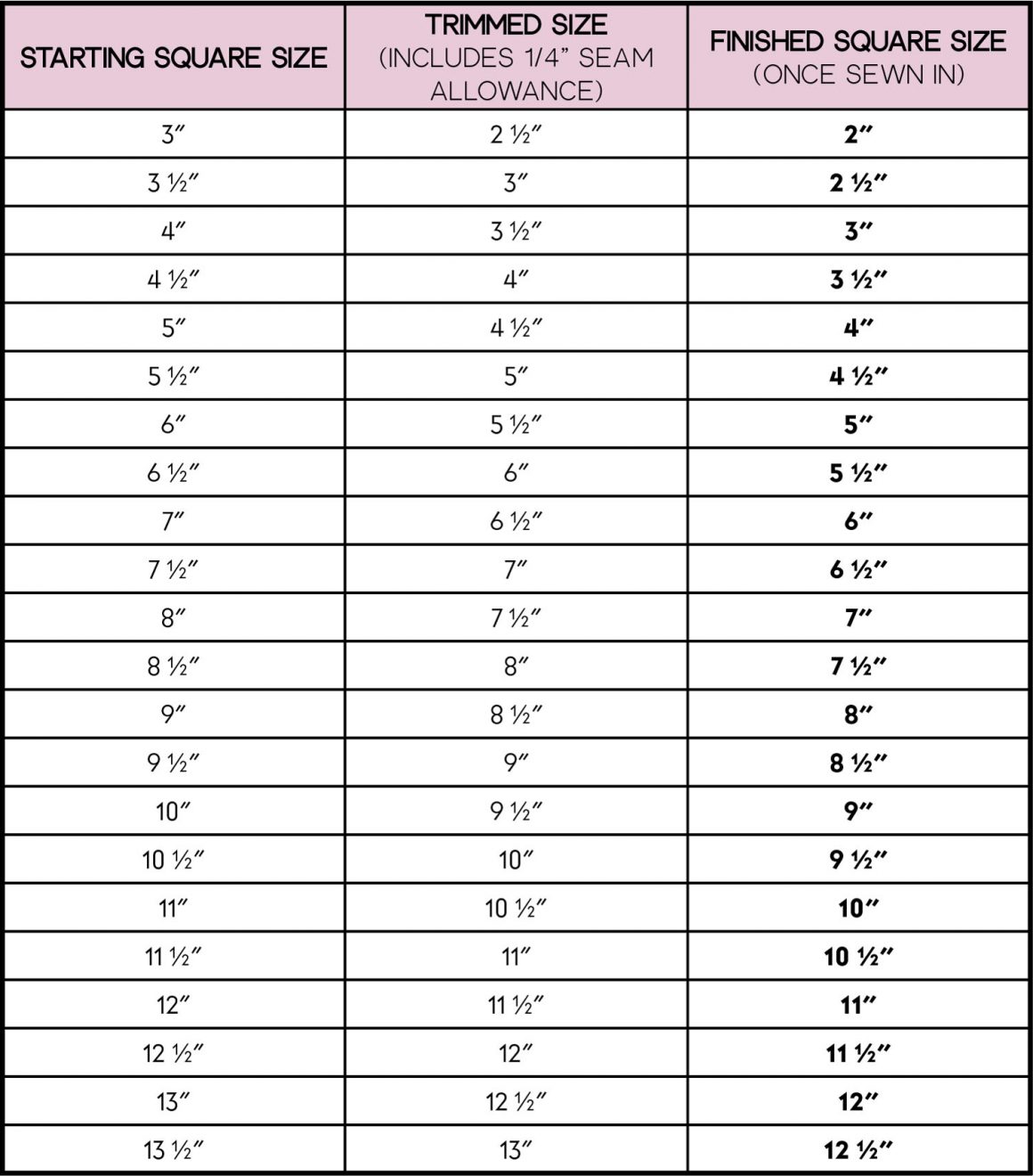

Four At A Time Half Square Triangles Chart

How to Make Half Square Triangles (HST) Tutorial Modernly

HST Tutorial

The Magic 8 Method Revealed Rachel Rossi Half square triangle quilts pattern, Triangle quilt

Easy Half Square Triangles Tutorial (VIDEO!) Suzy Quilts

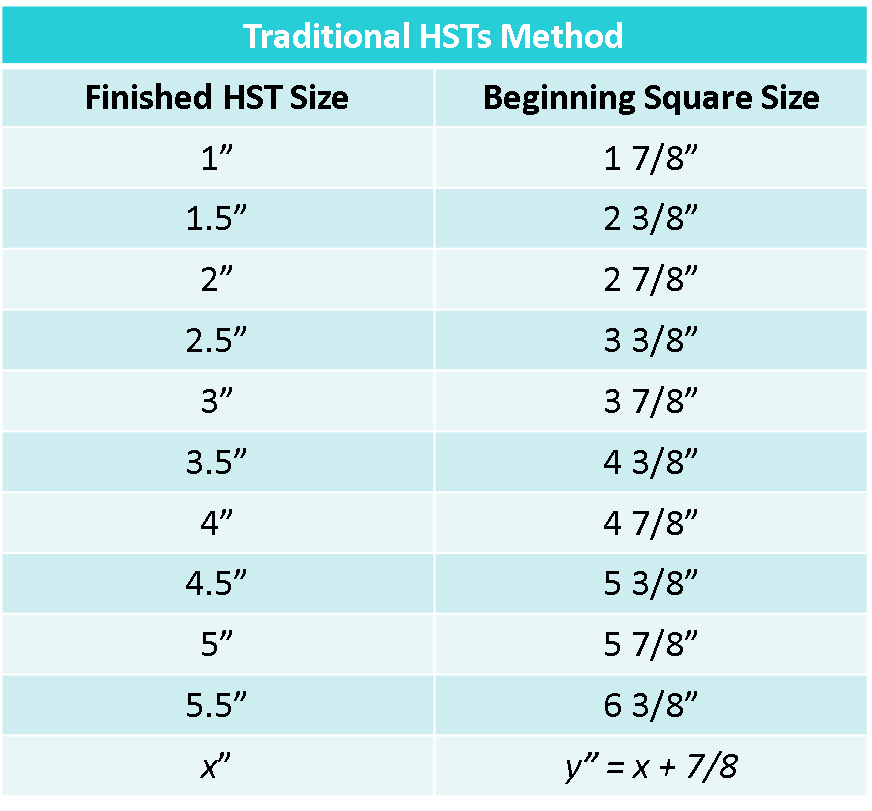

HST Chart & Instructions Threadgoode Quilting

HST Tutorial and Maths Formula Blossom Heart Quilts

Guide to setting triangles and squares, conversions. hst Half square triangle quilts, Chart

Cra Account, Netfile Form, Financial Institution, Accounting Software, Phone, Or Mail.

Gst/Hst Rates By Province Gst/Hst Calculators Sales Tax Calculator Use This Calculator To Find Out The Amount Of Tax That Applies To Sales In Canada.

Gst/Hst Calculator (And Rates) Fuse This Calculator To Find Out The Amount Of Tax That Applies To Sales In Canada, And Access The Gst/Hst Provincial Rates Table.

Related Post: