Ng2 Charts Chart Data Overlay Angular Not Working

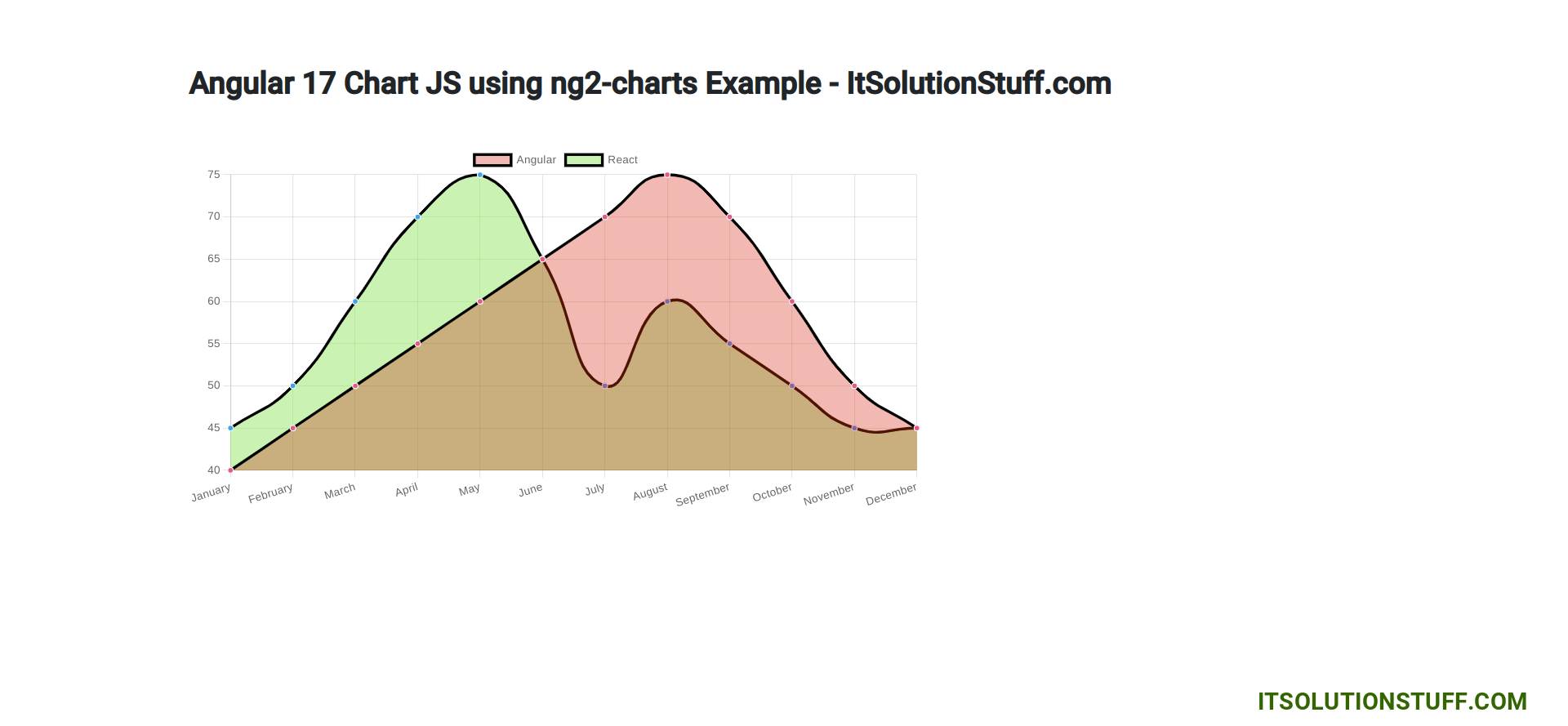

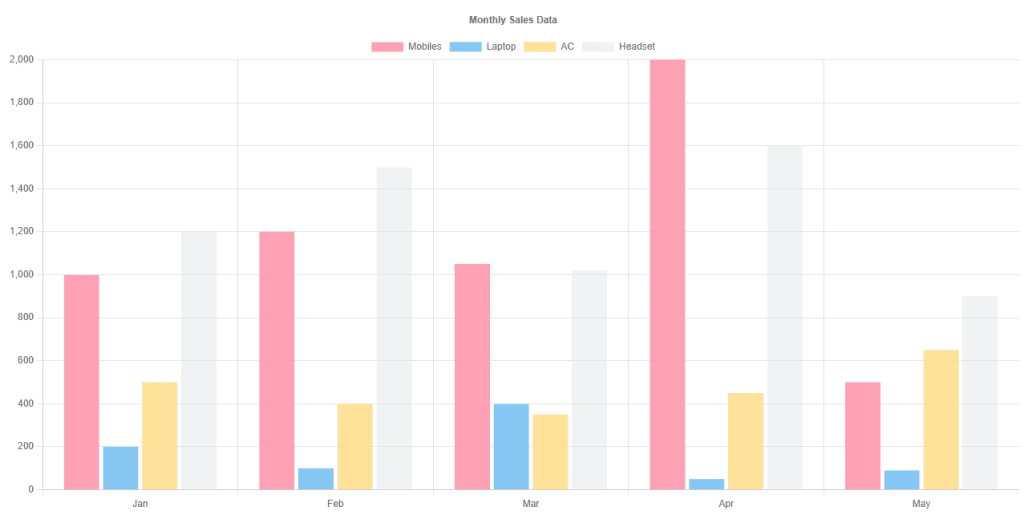

Ng2 Charts Chart Data Overlay Angular Not Working - A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. In our guide, we will explore call options in depth, starting with their definition and main characteristics. Call options are a kind of a derivatives contract that gives the buyer the right to buy a stock at. Of the two main types of options, calls and puts, it’s calls that are more popular. What is a call option? A call option is a contract with a fixed expiry date, which gives the holder of right to purchase the underlying asset at a specified strike price within a set. Call options are financial contracts that give the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specified price. A call option gives its owner a right to buy the underlying asset, while a put option gives its owner a right to sell the. Both have three essential characteristics: What is a call option? Both have three essential characteristics: A call option is a contract with a fixed expiry date, which gives the holder of right to purchase the underlying asset at a specified strike price within a set. Here is how these options work, the most common trading strategies and. Call option meaning describes a financial contract that allows but does not compel a buyer to buy an underlying asset at a predefined price within a certain time frame. In our guide, we will explore call options in depth, starting with their definition and main characteristics. A call is a contract that gives the owner of the option the right to purchase the underlying security at a. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option (as both are for bearish). A call option is a contract that gives the buyer the right, but not the obligation, to purchase an underlying asset like a stock or bond at a predetermined. What is a call option? A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. Both have three essential characteristics: Call option meaning describes a financial contract that allows but does not compel a buyer to buy an underlying asset at a predefined price within a certain time frame. Exercise price, expiration date, and time to expiration. A call option gives its owner a right to buy the underlying asset, while a put option gives. A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option (as both. Of the two main types of options, calls and puts, it’s calls that are more popular. Both have three essential characteristics: Call options are a kind of a derivatives contract that gives the buyer the right to buy a stock at. A call is a contract that gives the owner of the option the right to purchase the underlying security. A call is a contract that gives the owner of the option the right to purchase the underlying security at a. A call option gives its owner a right to buy the underlying asset, while a put option gives its owner a right to sell the. Call options are financial contracts that give the buyer the right, but not the. What is a call option? A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. There are two basic types of options, call options and put options. A call option is a contract with a fixed expiry date, which gives. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option (as both are for bearish). Call option meaning describes a financial contract that allows but does not compel a buyer to buy an underlying asset at a predefined price within a certain. In our guide, we will explore call options in depth, starting with their definition and main characteristics. A call option is a contract with a fixed expiry date, which gives the holder of right to purchase the underlying asset at a specified strike price within a set. There are two basic types of options, call options and put options. Here. What is a call option? Call options are financial contracts that give the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specified price. A call is a contract that gives the owner of the option the right to purchase the underlying security at a. How to decide whether. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option (as both are for bearish). A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder. In our guide, we will explore call options in depth, starting with their definition and main characteristics. A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. There are two main type of options. What is a call option? Exercise. Call options are financial contracts that give the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specified price. There are two basic types of options, call options and put options. Call options are a kind of a derivatives contract that gives the buyer the right to buy a stock at. How to decide whether to buy call option or sell a put option (as both are for bullish), similarly sell a call option or buy a put option (as both are for bearish). What is a call option? A call option gives its owner a right to buy the underlying asset, while a put option gives its owner a right to sell the. Call option meaning describes a financial contract that allows but does not compel a buyer to buy an underlying asset at a predefined price within a certain time frame. A call option gives the holder the right to buy an asset by a certain date for the strike price whereas a put option gives the holder the right to. There are two main type of options. Both have three essential characteristics: Here is how these options work, the most common trading strategies and. A call option is a contract with a fixed expiry date, which gives the holder of right to purchase the underlying asset at a specified strike price within a set. Of the two main types of options, calls and puts, it’s calls that are more popular. Exercise price, expiration date, and time to expiration.Angular 18 Chart JS using ng2charts Example

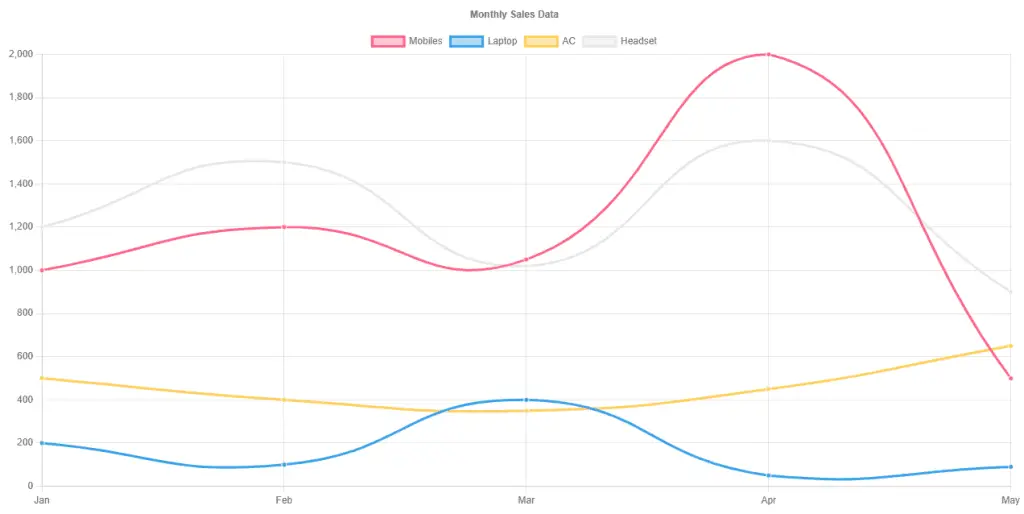

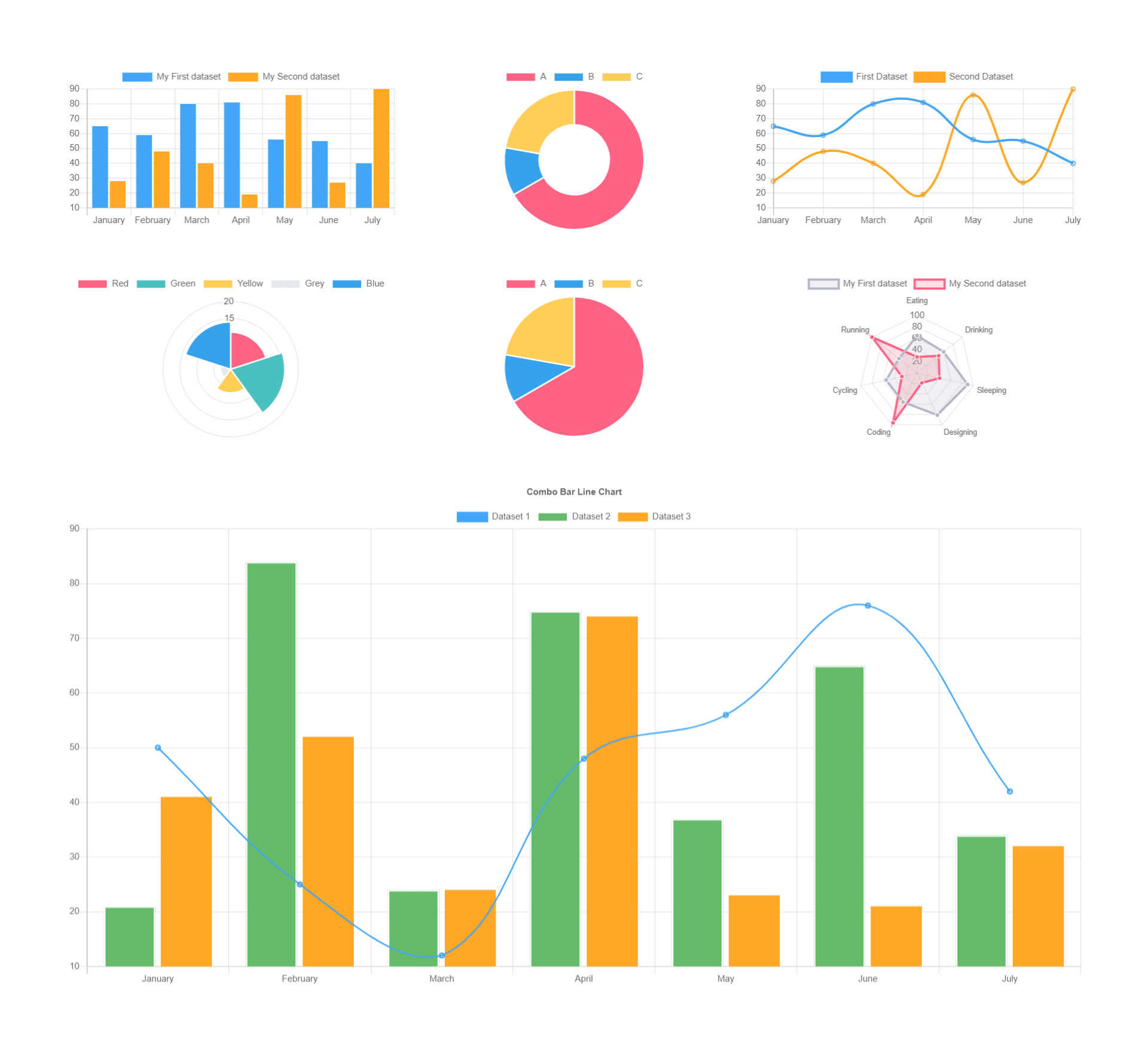

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

Visualizing Data With NGXCharts In Angular Knoldus Blogs, 55 OFF

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

ng2 charts in Angular Chart.js Blog DJobBuzz

How To Use Chart.js in Angular with ng2charts DigitalOcean

ng2charts data json overlay angular not working Awesome charts in angular 13 with ng2charts

What Is A Call Option?

A Call Is A Contract That Gives The Owner Of The Option The Right To Purchase The Underlying Security At A.

In Our Guide, We Will Explore Call Options In Depth, Starting With Their Definition And Main Characteristics.

A Call Option Is A Contract That Gives The Buyer The Right, But Not The Obligation, To Purchase An Underlying Asset Like A Stock Or Bond At A Predetermined.

Related Post: