Options Strategy Chart

Options Strategy Chart - Call options and put options. Learn what are options in simple terms. Learn everything you need to know about options on etoro. Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Options are a type of derivative, which means they derive their value from an underlying asset. This underlying asset can be a stock, a commodity, a currency or a bond. Options are available on numerous financial products, including equities, indices, and etfs. Confused with all the financial jargon? Here’s what you need to know to get started with options trading. Options are contracts that give you the right to buy or sell an asset at a specific price by a specific time. Options are contracts that give investors the option to buy or sell a security at a specific price. This underlying asset can be a stock, a commodity, a currency or a bond. Options are contracts that give you the right to buy or sell an asset at a specific price by a specific time. Options are called derivatives because the value of the option is derived from the. This article explains what options are, how calls and puts work, and how traders use them for speculation or hedging. This is the ultimate guide to understanding options for dummies. Confused with all the financial jargon? Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Learn everything you need to know about options on etoro. Discover what options trading is, how to trade options and review four core strategies available to individual investors. Here’s what you need to know to get started with options trading. Learn everything you need to know about options on etoro. Options are versatile financial instruments that offer traders and investors a unique way to engage with the markets. Options are called derivatives because the value of the option is derived from the. Options are contracts that give you. Here’s what you need to know to get started with options trading. This is the ultimate guide to understanding options for dummies. Options are called derivatives because the value of the option is derived from the. Options are versatile financial instruments that offer traders and investors a unique way to engage with the markets. Options are contracts that give you. Whether you're looking to amplify gains, hedge against. Learn what are options in simple terms. Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Here’s what you need to know to get started with options trading. Options are a type of derivative, which means they derive their value from an underlying asset. Whether you're looking to amplify gains, hedge against. Options are contracts that give investors the option to buy or sell a security at a specific price. Call options and put options. Options are contracts that give you the right to buy or sell an asset at a specific price by a specific time. Discover the fundamentals of options trading, including. Whether you're looking to amplify gains, hedge against. Confused with all the financial jargon? Learn everything you need to know about options on etoro. Options are versatile financial instruments that offer traders and investors a unique way to engage with the markets. Options are a type of derivative, which means they derive their value from an underlying asset. Whether you're looking to amplify gains, hedge against. Options are called derivatives because the value of the option is derived from the. Options are a type of derivative, which means they derive their value from an underlying asset. Call options and put options. Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Here’s what you need to know to get started with options trading. Discover what options trading is, how to trade options and review four core strategies available to individual investors. This article explains what options are, how calls and puts work, and how traders use them for speculation or hedging. Options are contracts that give investors the option to buy. This article explains what options are, how calls and puts work, and how traders use them for speculation or hedging. Whether you're looking to amplify gains, hedge against. Options are called derivatives because the value of the option is derived from the. Learn everything you need to know about options on etoro. This underlying asset can be a stock, a. Options are a type of derivative, which means they derive their value from an underlying asset. This underlying asset can be a stock, a commodity, a currency or a bond. Options are contracts that give you the right to buy or sell an asset at a specific price by a specific time. Call options and put options. Discover what options. Learn what are options in simple terms. Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Options are a type of derivative, which means they derive their value from an underlying asset. Call options and put options. Whether you're looking to amplify gains, hedge against. Options are contracts that give investors the option to buy or sell a security at a specific price. Learn everything you need to know about options on etoro. Discover what options trading is, how to trade options and review four core strategies available to individual investors. Learn what are options in simple terms. Options are versatile financial instruments that offer traders and investors a unique way to engage with the markets. Options are contracts that give you the right to buy or sell an asset at a specific price by a specific time. Here’s what you need to know to get started with options trading. Confused with all the financial jargon? Discover the fundamentals of options trading, including calls, puts, strategies, and risks, to enhance your investment approach. Whether you're looking to amplify gains, hedge against. Options are called derivatives because the value of the option is derived from the. Call options and put options. This is the ultimate guide to understanding options for dummies.Basic Options Strategies Explained The Options Bro Stock Options Trading, Online Stock Trading

Options Trading Guide Archives Strike

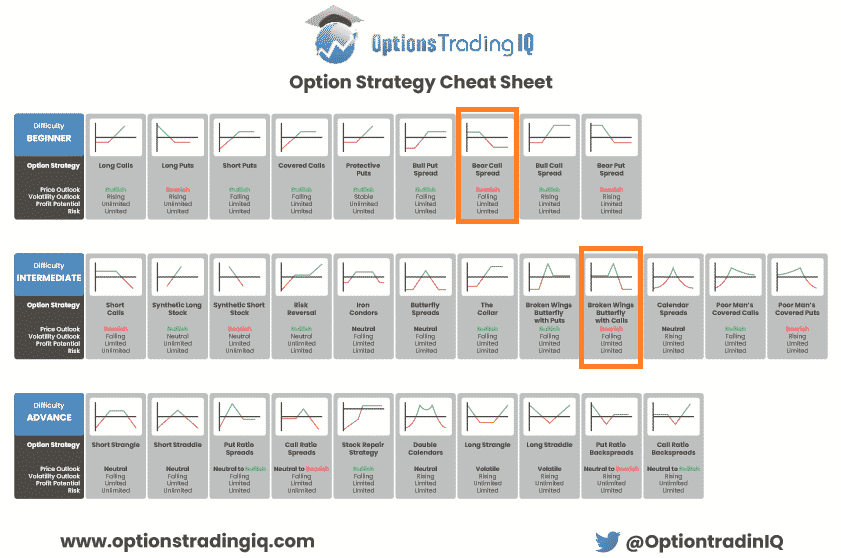

Option Strategy Cheat Sheet Two Free Downloads

TOP OPTIONS STRATEGIES poster. options trader gift Option strategies, Option trading, Stock

Master the Top Options Strategies

10 Options Strategies Every Investor Should Know

10 Options Strategies Every Investor Should Know

Options Strategies Cheat Sheet [FREE Download] How to Trade

10 Options Strategies Every Investor Should Know

Options Strategies Cheatsheet. Here is a ready referral to Option… by Sensibull Medium

This Underlying Asset Can Be A Stock, A Commodity, A Currency Or A Bond.

Options Are A Type Of Derivative, Which Means They Derive Their Value From An Underlying Asset.

Options Are Available On Numerous Financial Products, Including Equities, Indices, And Etfs.

This Article Explains What Options Are, How Calls And Puts Work, And How Traders Use Them For Speculation Or Hedging.

Related Post:

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-b0aa70d4f6004811811f8b07f034efd4.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

![Options Strategies Cheat Sheet [FREE Download] How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1024x724.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)