Tarrifs Chart

Tarrifs Chart - The words ‘tariff,’ ‘duty,’ and ‘customs’ can be used. Tariffs are taxes imposed by a government on goods and services imported from other countries. Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. A tariff is a tax that governments place on goods coming into their country. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Tariffs are a tax imposed by one country on goods and services imported from another country. Tariffs—taxes placed on imported goods—are one of the oldest tools in the united states’ economic policy arsenal, dating back to the 18th century. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). You might also hear them called duties or customs duties—trade experts use these. Tariffs, sometimes called duties or customs duties, are taxes on goods that are traded between nations. A tariff is a tax that governments place on goods coming into their country. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be used. Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. Think of tariff like an extra cost added to foreign products when they enter the. What is a tariff and what is its function? The most common type is an import tariff, which taxes goods brought into a country. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Tariffs on imports are designed to raise the. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. A tariff is a tax placed on goods when they cross national borders. Think of tariff like an extra cost added to foreign products when they enter the. Tariffs are taxes imposed by a government on goods and services imported from other countries. Tariffs on imports are designed to raise the. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount. In the united states, tariffs are collected by customs and border. The most common type is an import tariff, which taxes goods brought into a country. Tariffs are a tax imposed by one country on goods and services imported from another country. Think of tariff like an extra cost added to foreign products when they enter the. A tariff is. Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. The most common type is an import tariff, which taxes goods brought into a country. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be used. In the united states, tariffs are collected by customs and border. Simply put, they increase the price of goods and. Think of tariff like an extra cost added to foreign products when they enter the. Tariffs are a tax on imports. Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. Tariffs are used to restrict imports. In the united states, tariffs are collected by customs and border. Tariffs on imports are designed to raise the. Tariffs are a tax imposed by one country on goods and services imported from another country. Think of tariff like an extra cost added to foreign products when they enter the. Tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Tariffs are used. Tariffs are used to restrict imports. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Think of tariff like an extra cost added to foreign products when they enter the. Tariffs are a tax imposed by one country on goods and services imported from another country. The words. A tariff is a tax placed on goods when they cross national borders. Tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Tariffs—taxes placed on imported goods—are one of the oldest tools in the united states’ economic policy arsenal, dating back to the 18th century. Recently they’ve returned to the. In. When goods cross the us border, customs and border protection (cbp). Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). The. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Tariffs are used to restrict imports. Tariffs, sometimes called duties or customs duties, are taxes on goods that are traded between nations. A tariff is a tax placed on goods when they cross national borders. Tariffs—taxes placed on imported. Tariffs are a tax imposed by one country on goods and services imported from another country. Recently they’ve returned to the. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price). You might also hear them called duties or customs duties—trade experts use these. Tariffs are a tax on imports. Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. Tariffs are taxes imposed by a government on goods and services imported from other countries. Tariffs on imports are designed to raise the. Tariffs—taxes placed on imported goods—are one of the oldest tools in the united states’ economic policy arsenal, dating back to the 18th century. Tariffs are a tax imposed by one country on goods and services imported from another country. Simply put, they increase the price of goods and services purchased from another country, making them less attractive to domestic consumers. Recently they’ve returned to the. Tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be used. In the united states, tariffs are collected by customs and border. A tariff is a tax placed on goods when they cross national borders. What is a tariff and what is its function? Tariffs, sometimes called duties or customs duties, are taxes on goods that are traded between nations. Tariffs are used to restrict imports.Trump's global tariff pause is supposed to expire soon. What's at stake for Canada? CBC News

Trading Tariffs How Tariffs Impact Stock Markets The Chart Guys

Navigating the Tariff Storm Part IX How the Global Trade War is Heating Up Sedlak

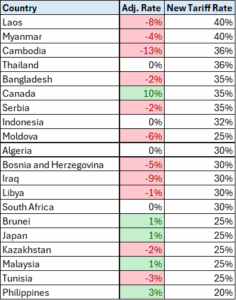

The chart detailing the new tariffs that the United States will impose on imported goods

Trump trade war Tariff deadlines and key events

Tariffs, Inflation and Other Key Things to Watch this…

Gold Forecast Today 14/07 Surges On Tariff Fears (Chart)

Trading Tariffs How Tariffs Impact Stock Markets The Chart Guys

71525 Trump’s Game of “Tariff Chicken” Enters the Final Stage Navellier

Trump slaps 30 to 50 tariffs on THESE countries

A Tariff Is A Tax That Governments Place On Goods Coming Into Their Country.

Think Of Tariff Like An Extra Cost Added To Foreign Products When They Enter The.

The Most Common Type Is An Import Tariff, Which Taxes Goods Brought Into A Country.

Tariffs Can Be Fixed (A Constant Sum Per Unit Of Imported Goods Or A Percentage Of The Price) Or Variable (The Amount Varies According To The Price).

Related Post: