Valuation Chart

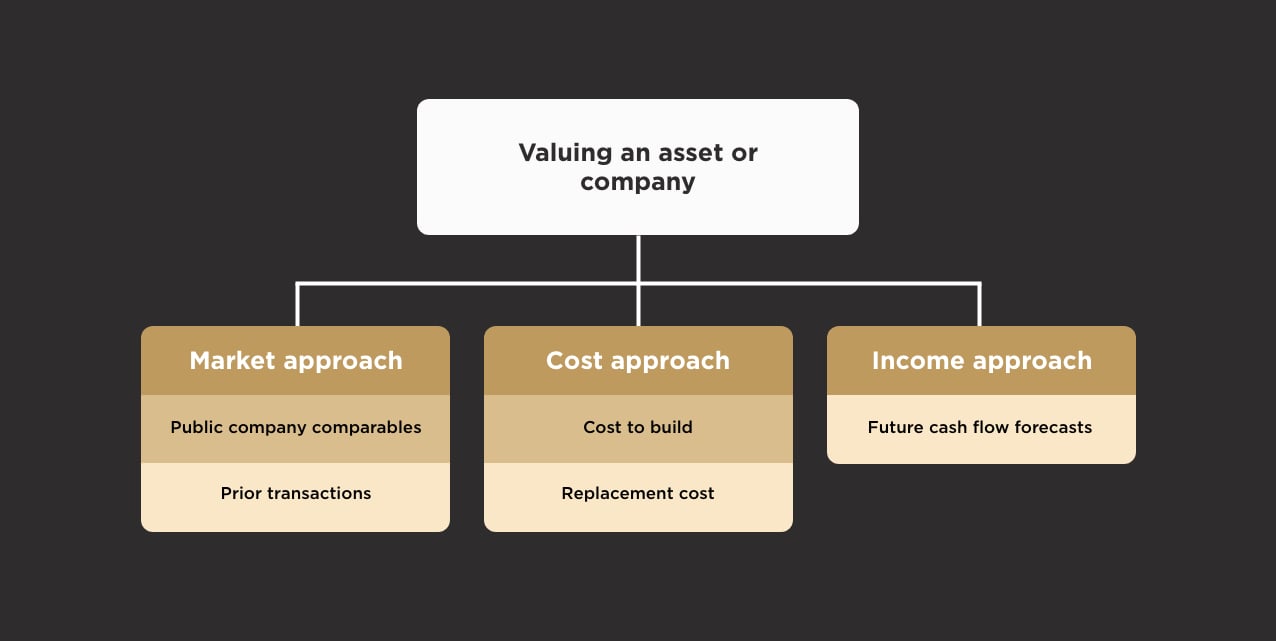

Valuation Chart - Below are three major valuation methods that are. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Find out how to take the next step in your learning journey. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Below are three major valuation methods that are. Find out how to take the next step in your learning journey. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Below are three major valuation methods that are. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Find out how to take the next step in your learning journey. Explore. Find out how to take the next step in your learning journey. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation,. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price.. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Thus, valuation is an important part of mergers and acquisitions (m&a), as it. Below are three major valuation methods that are. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Find out how to take. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Below are three major valuation methods that are. Business valuation involves the determination of. Fmva® program overview cfi's financial modeling & valuation analyst (fmva®) certification imparts vital financial analysis skills, emphasizing constructing effective financial models for. Find out how to take the next step in your learning journey. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Thus, valuation is. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. Explore cfi's valuation courses to find expert insights and learn about different methods and tools to make informed financial decisions and drive growth. Find out how to take the next step in your learning journey. Below. Thus, valuation is an important part of mergers and acquisitions (m&a), as it guides the buyer and seller to reach the final transaction price. The ebitda multiple is a financial ratio that compares a company's enterprise value to its annual ebitda. Business valuation involves the determination of the fair economic value of a company or business for various reasons such as sale value, divorce litigation, and. Find out how to take the next step in your learning journey. Explore expert valuation resources to build a stronger understanding of core concepts and techniques. Below are three major valuation methods that are.PreMoney vs. PostMoney Valuations How to Calculate Each

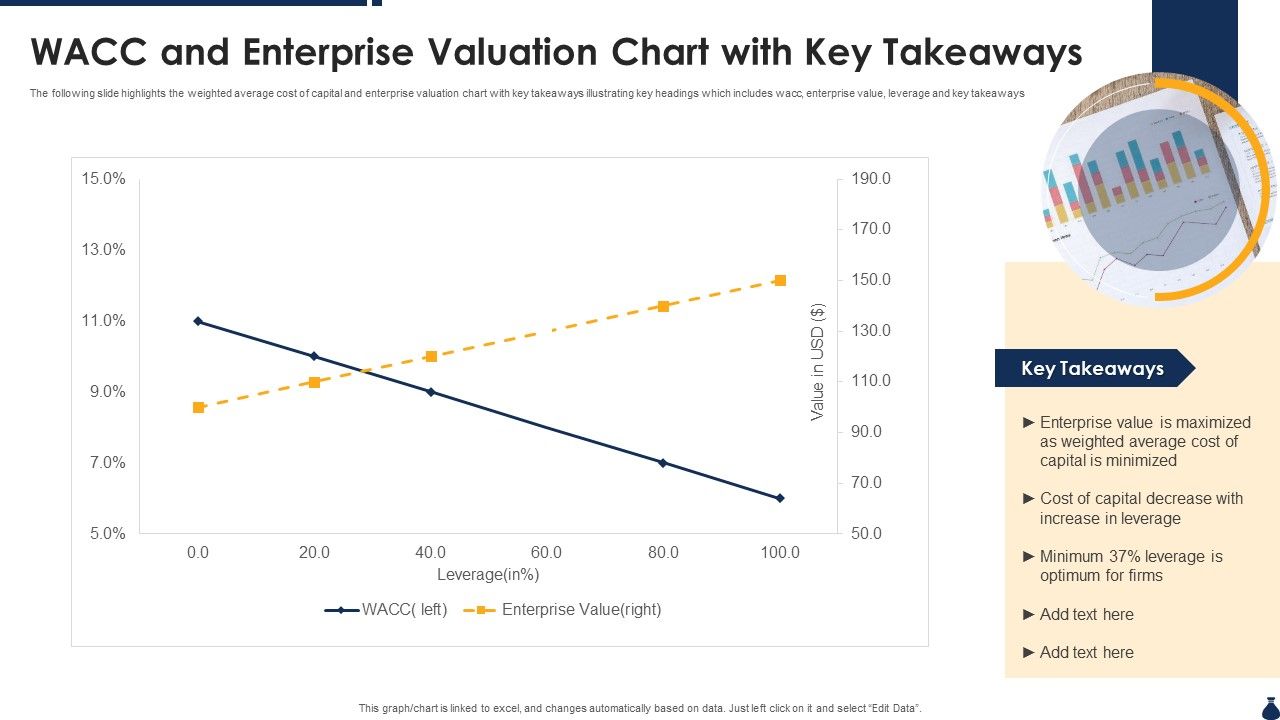

WACC And Enterprise Valuation Chart With Key Takeaways PPT Sample

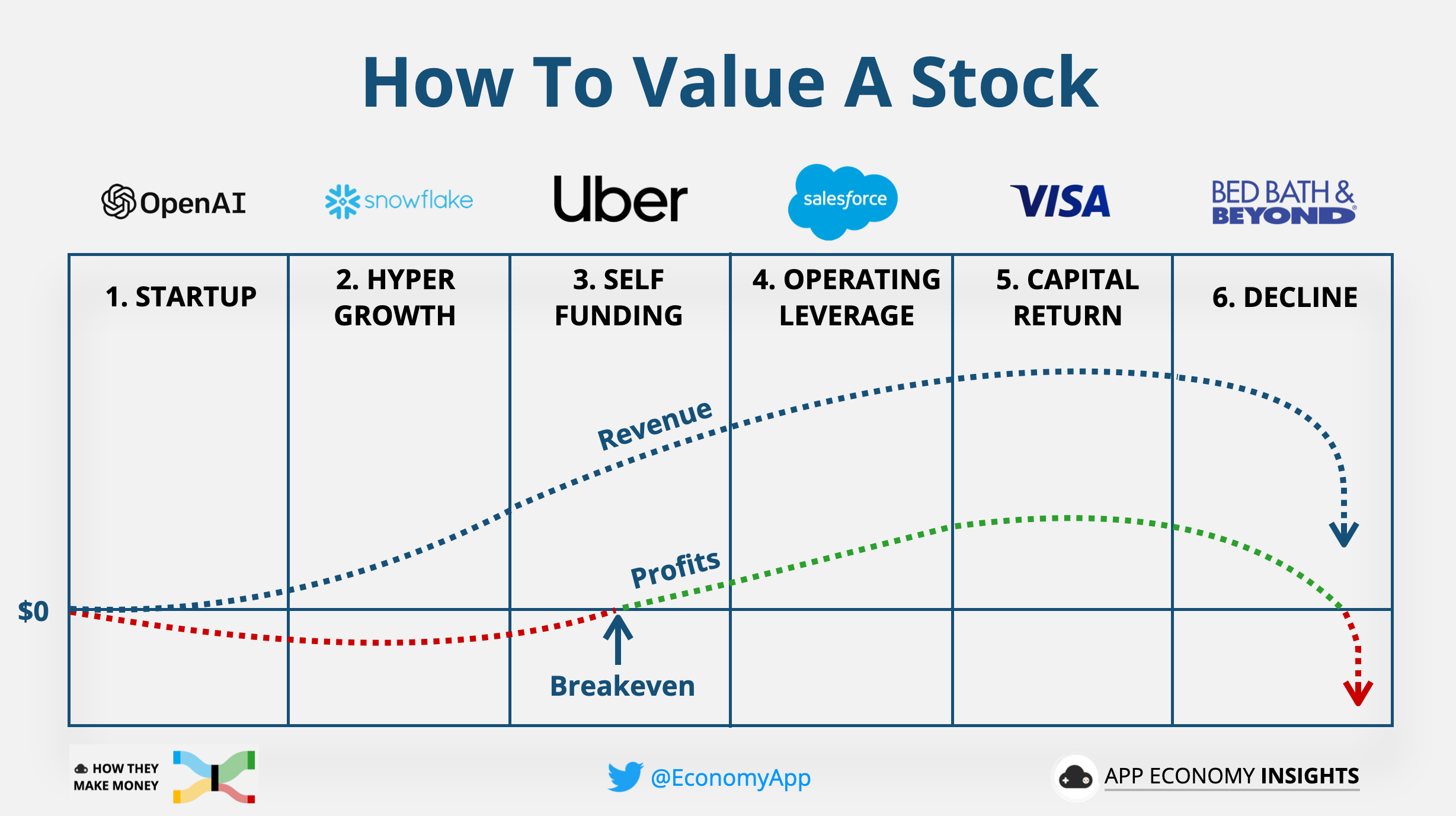

🔍 How To Value A Stock The Ultimate Guide

Valuation Methods A Guide

A Guide to the Different Types of Valuation Models for Private Companies

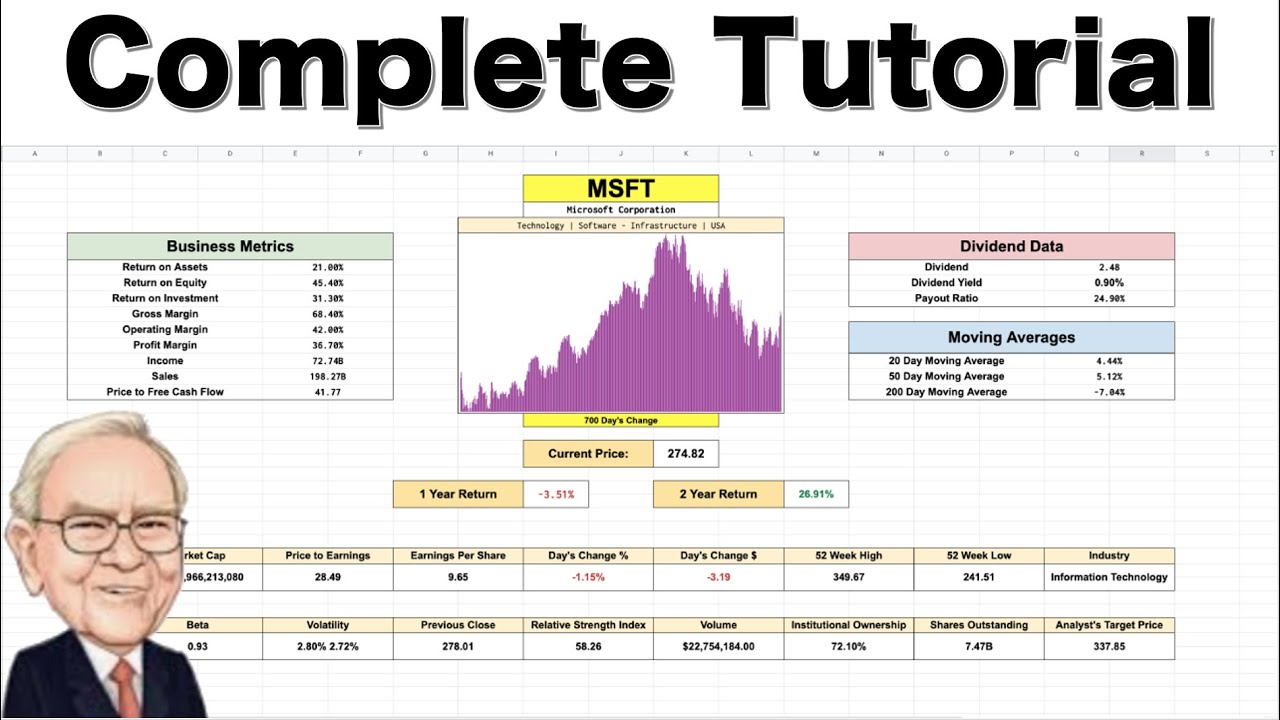

Stock Valuation Spreadsheet

10 Valuation Charts Seeking Alpha

How to Calculate Equity Value Equity IPO Guide Wealthfront

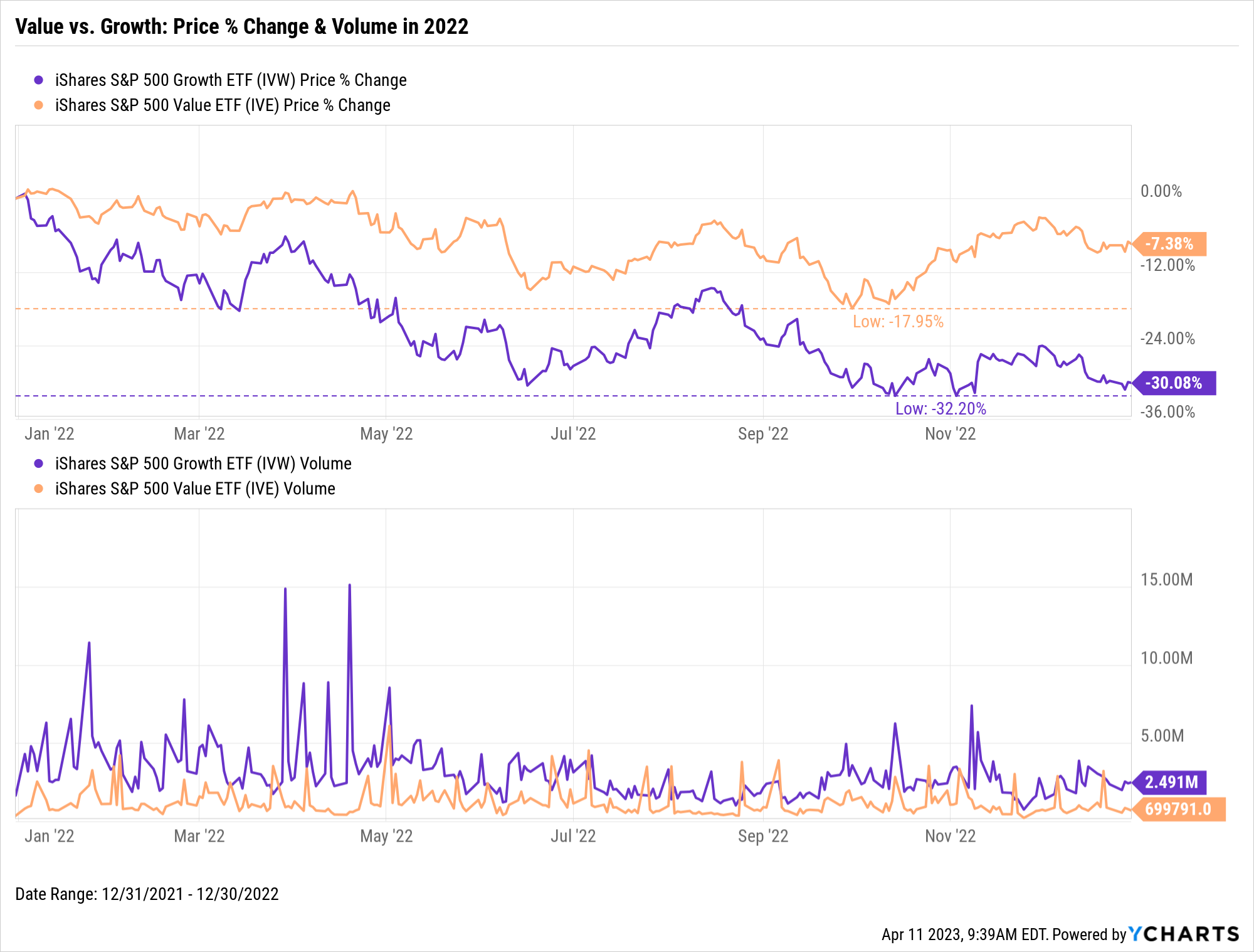

Value vs Growth Current Trends, Top Stocks & ETFs YCharts

How To Calculate The Value Of A Company Car at Stanley Harrison blog

Fmva® Program Overview Cfi's Financial Modeling & Valuation Analyst (Fmva®) Certification Imparts Vital Financial Analysis Skills, Emphasizing Constructing Effective Financial Models For.

Explore Cfi's Valuation Courses To Find Expert Insights And Learn About Different Methods And Tools To Make Informed Financial Decisions And Drive Growth.

Related Post: